The Transrail Lighting IPO allotment status is now available as the basis of allotment has been finalized. The IPO subscription period, which ended on December 23, 2024, saw an overwhelming response from investors, being subscribed 80.80 times overall. Investors who applied for the IPO can check the allotment status online on Tuesday, December 24, 2024, through the Link Intime India Private Limited website or the BSE and NSE websites. The IPO’s grey market premium (GMP) reached approximately ₹175 post-subscription, reflecting the strong demand for the issue.

Transrail Lighting Basis of IPO Allotment Status

The basis of allotment for the Transrail Lighting IPO has been finalized, providing insights into the allocation process for different investor categories. For big non-institutional investors (HNIs), the allotment ratio was 1 out of 15 applications, while for small HNIs, it was 1 out of 79 applications. Retail investors had an allotment ratio of 1 out of 19 applications, reflecting the strong demand across all investor segments.

Check Transrail Lighting IPO Allotment Links

| Linkintime: | Linkintime IPO Allotment Page |

| BSE: | BSE IPO Allotment Page |

| Equity Market Insights | IPO Allotment Status Page |

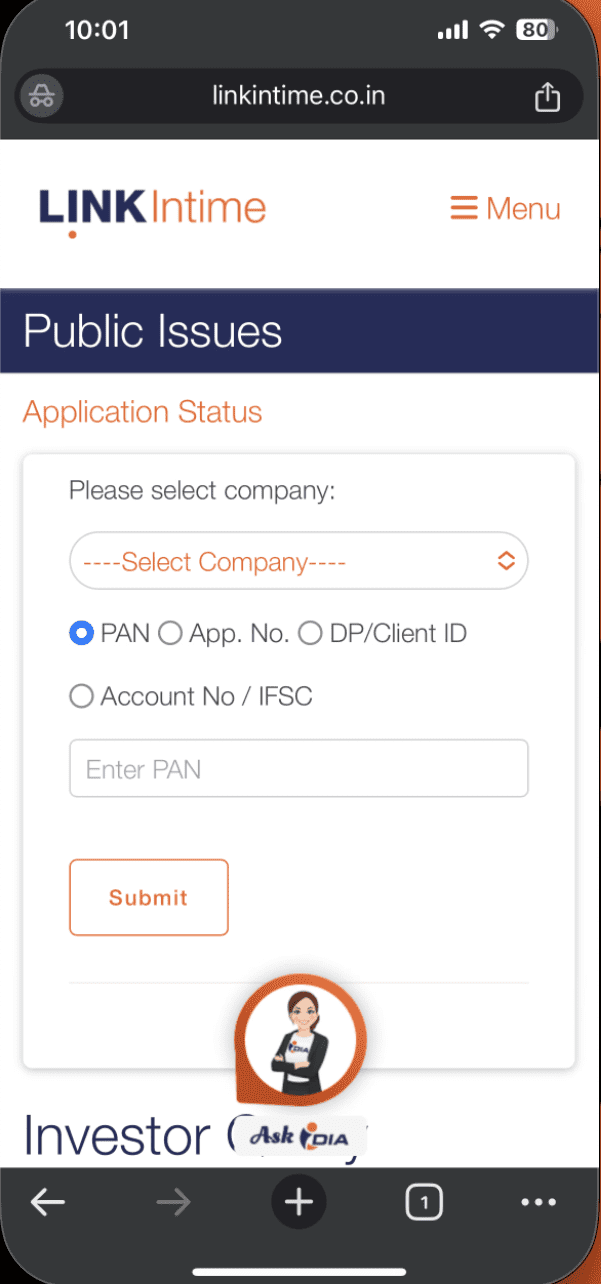

Step 1: How to Check Transrail Lighting IPO Allotment Status on Link Intime Website

- Visit the Link Intime IPO Allotment page.

- Select the IPO name ‘Transrail Lighting’ from the dropdown menu.

- Choose your preferred identification method: PAN Number, Application Number, or DP ID/Client ID.

- Enter the respective details as per your selection.

- Click on the ‘Search’ button.

- View your allotment status on the screen (mobile or desktop).

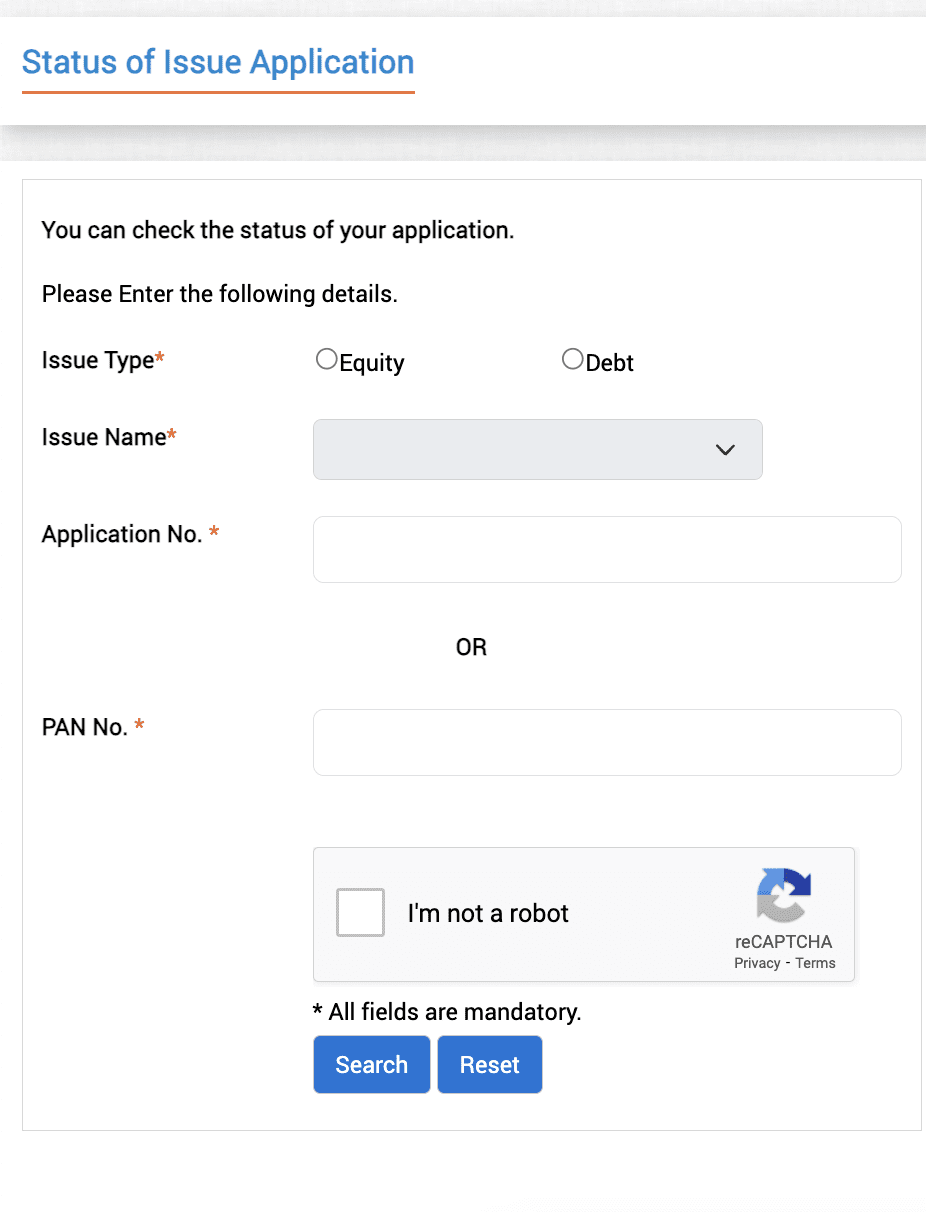

Step 2: How to Check Transrail Lighting Allotment Status on the BSE Website

- Visit the BSE IPO Allotment page.

- Select the IPO name ‘Transrail Lighting’ from the dropdown menu.

- Choose your preferred identification method: PAN Number, Application Number, or DP ID/Client ID.

- Enter the respective details as per your selection.

- Click on the ‘Search’ button.

- Check your allotment status displayed on the screen.

Step 3: How to Check Transrail Lighting Allotment Status in Your Demat Account

- Contact your broker or log in to your Demat/Trading account.

- Verify whether the allocated shares are credited to your Demat account.

- If you received the allotment, the shares will appear under your holdings.

Step 4: How to Check Transrail Lighting Allotment Through Your Bank Account

- Log in to the bank account used to apply for the IPO.

- Navigate to the account’s balance or transaction details.

- If shares are allotted, the IPO amount will be debited from your account.

- If shares are not allotted, the blocked amount will be released back to your account.

- In case of allotment, you will receive an SMS notification from your bank, such as:

“Dear Customer, [Bank Name] Account [Account Number] is debited with INR [Amount] on [Date]. Info: Transrail Lighting IPO. Available Balance is INR [Balance Amount].”

By following these steps, you can easily check the allotment status of the Transrail Lighting IPO.

Transrail Lighting IPO Dates

| Event | Date | Details |

|---|---|---|

| IPO Open Date | Thursday, December 19, 2024 | Investors can start subscribing to the IPO from this date. |

| IPO Close Date | Monday, December 23, 2024 | Last date to apply for the IPO. |

| Cut-off Time for UPI Mandate Confirmation | 5 PM on December 23, 2024 | Deadline to approve UPI mandates to ensure application validity. |

| Basis of Allotment Finalization | Tuesday, December 24, 2024 | Shares will be allotted to investors as per the subscription. |

| Initiation of Refunds | Thursday, December 26, 2024 | Refunds will be initiated for unsuccessful applications. |

| Credit of Shares to Demat Accounts | Thursday, December 26, 2024 | Shares will be credited to investors' Demat accounts before the listing. |

| Listing Date | Friday, December 27, 2024 | Shares will start trading on BSE and NSE. |

| Application Mode | Online (via UPI), Offline | Investors can apply through UPI-based applications or ASBA via banks. |

About Company

Transrail Lighting Limited, established in 2008, is a leading engineering and construction company specializing in power transmission and distribution. Operating in 58 countries, including Bangladesh, Kenya, Finland, and Poland, the company has completed over 200 projects worldwide. It offers end-to-end EPC services and manufactures lattice structures, conductors, and monopoles, supported by four manufacturing facilities across Gujarat, Maharashtra, and Silvassa.

With expertise in civil construction and railway services, Transrail Lighting has supplied 1.3 MMT of towers, 194,534 KM of conductors, and 458,705 poles. As of June 2024, it has executed 34,654 CKM of transmission and 30,000 CKM of distribution lines. The company employs 1,575 professionals and reported revenue growth from ₹2,139.09 crore in 2021 to ₹4,130 crore in 2024, reflecting its robust operational and financial strength.

Transrail Lighting IPO Allotment Status FAQs

How to Check Transrail Lighting IPO Allotment Status?

You can check the allotment status on the Link Intime website or the BSE website by entering your PAN, application number, or DP ID.

When Will Shares Be Credited to the Demat Account?

Shares will be credited on or before December 26, 2024, if allotted.

How to Confirm IPO Allotment?

Check the allotment status online, verify your Demat account for credited shares, or check your bank account for a debit.

What Happens if Allotment Is Not Received?

The blocked amount will be released to your bank account within 2-3 working days.

What Is the Listing Date for the IPO Shares?

The shares are expected to be listed on December 27, 2024.

What Is the Basis of Allotment?

- Big HNI: 1 out of 15

- Small HNI: 1 out of 79

- Retail: 1 out of 19

Who Is the IPO Registrar?

The registrar is Link Intime India Private Limited.

What Was the Subscription Rate?

The IPO was subscribed 80.80 times overall, with strong demand from investors.

What Was the IPO Price Band and Lot Size?

The price band was ₹410-₹432 per share, and the lot size was 34 shares.

Can Allotment Be Checked via a Broker?

Yes, you can check with your broker or through your trading account.