Ganesh Infraworld IPO is a fresh issue, aiming to raise ₹98.58 crores by offering 118.77 lakh equity shares. The subscription period for this IPO begins on November 29, 2024, and closes on December 3, 2024. After the allotment is finalized on December 4, 2024, the shares are set to list on the NSE SME platform on December 6, 2024.

The IPO price range is set between ₹78 and ₹83 per share. Retail investors can start with a minimum application of 1,600 shares, requiring an investment of ₹132,800. For larger investors (HNIs), the minimum application is 2 lots (3,200 shares), amounting to ₹265,600. This IPO provides a fresh investment opportunity for those looking to participate in the SME segment.

Ganesh Infraworld IPO – Overview

| IPO Date | November 29, 2024 to December 3, 2024 |

|---|---|

| Listing Date | December 6, 2024 |

| Face Value | ₹5 per share |

| Price Band | ₹78 to ₹83 per share |

| Lot Size | 1600 Shares |

| Total Issue Size | 11,876,800 shares |

| Fresh Issue | 11,876,800 shares |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 30,844,597 |

| Share holding post issue | 42,721,397 |

| Market Maker portion | 1,187,200 shares |

Timeline

| IPO Name | Ganesh Infraworld Limited |

|---|---|

| IPO Open Date | Friday, November 29, 2024 |

| IPO Close Date | Tuesday, December 3, 2024 |

| Basis of Allotment | Wednesday, December 4, 2024 |

| Initiation of Refunds | Thursday, December 5, 2024 |

| Credit of Shares to Demat | Thursday, December 5, 2024 |

| Listing Date | Friday, December 6, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on December 3, 2024 |

Reservation

In the Ganesh Infraworld IPO, the allocation of shares is divided among different investor categories. Qualified Institutional Buyers (QIBs) will be offered not more than 50% of the net offer, while Retail Individual Investors (RIIs) will receive not less than 35% of the total offer. The remaining 15% of the offer is reserved for Non-Institutional Investors (NIIs), commonly referred to as High Net-Worth Individuals (HNIs). This structured allocation ensures a balanced participation across various investor segments.

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50.00% of the Net offer |

| Retail Shares Offered | Not less than 35.00% of the Offer |

| NII (HNI) Shares Offered | Not less than 15.00% of the Offer |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1600 | ₹132,800 |

| Retail (Max) | 1 | 1600 | ₹132,800 |

| HNI (Min) | 2 | 3,200 | ₹265,600 |

Promoter Holding

| Share Holding Pre Issue | 81.84% |

|---|---|

| Share Holding Post Issue |

Financial Information

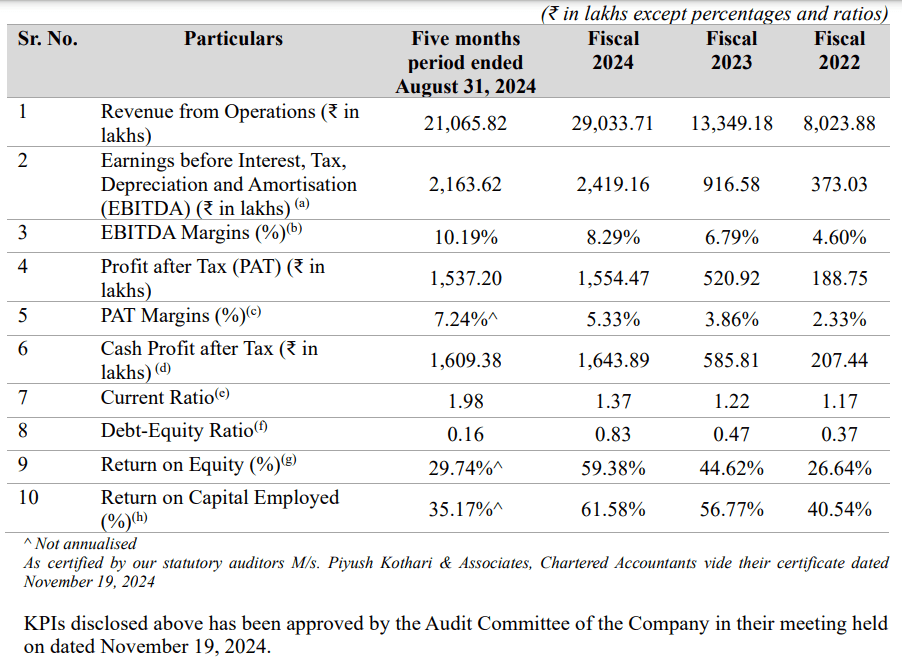

Ganesh Infraworld Limited achieved remarkable financial growth, with revenue increasing by 116% and profit after tax (PAT) surging by 198% between the fiscal years ending March 31, 2023, and March 31, 2024.

| Period Ended | 31 Aug 2024 | 31 Mar 2024 | 31 Mar 2023 | 31 Mar 2022 |

|---|---|---|---|---|

| Assets | 12,006.17 | 17,725.32 | 4,266.89 | 2,529.77 |

| Revenue | 21,232.86 | 29,181.12 | 13,504.85 | 8,115.46 |

| Profit After Tax | 1,537.2 | 1,554.47 | 520.92 | 188.75 |

| Net Worth | 6,617.24 | 3,720.04 | 1,515.22 | 819.44 |

| Reserves and Surplus | 5,075.01 | 2,622.26 | ||

| Total Borrowing | 1,033.02 | 3,072.42 | 708.96 | 304.99 |

Key Performance Indicator

| KPI | Values |

|---|---|

| ROE | 29.74 |

| ROCE | 35.17 |

| Debt/Equity | 0.16 |

| RoNW | 29.74 |

| P/BV | 3.87 |

| PAT Margin (%) | 7.24 |

About Company

Established in 2017, Ganesh Infraworld Limited is a construction company specializing in a wide range of infrastructure and construction-related services across India. The company focuses on developing industrial, civil, residential, and commercial buildings, as well as executing road, railway, power, and water distribution projects.