The Arisinfra Solutions IPO Allotment Status is available now. The IPO subscription had started on June 18, 2025, and ended on June 20, 2025, Friday. The allotment was released on June 23, 2025, Monday, after the basis of allotment was finalized.

The investors who applied for the IPO will be able to check the Arisinfra Solutions IPO Allotment Status on the MUFG Intime India Private Ltd website or BSE, NSE website. The IPO GMP went around ₹23 level after the subscription ended.

Overview of Contents

Arisinfra Solutions IPO Subsciption Details

As of June 20, 2025, at 5:04 PM (Day 3), the Arisinfra Solutions IPO received an overall subscription of 2.80 times. The retail investor category witnessed a strong response, being subscribed 5.90 times, while the Non-Institutional Investors (NII) category was subscribed 3.32 times. Within the NII segment, bids above ₹10 lakhs (bNII) were subscribed 2.98 times, and bids below ₹10 lakhs (sNII) were subscribed 3.61 times.

The Qualified Institutional Buyers (QIB) category saw a modest interest with 1.50 times subscription. Anchor investors were allotted 1,01,26,946 shares amounting to ₹224.81 crore. In total, the IPO received bids for 3.46 crore shares against the 1.23 crore shares offered, raising approximately ₹769.11 crore, with 1,78,851 total applications received. This strong retail and NII participation reflects positive sentiment around the IPO.

Arisinfra Solutions IPO Dates

| Event | Date |

|---|---|

| IPO Open Date: | June 18, 2025 |

| IPO Close Date: | June 20, 2025 |

| Basis of Allotment: | June 23, 2025 |

| Refunds: | June 24, 2025 |

| Credit to Demat Account: | June 24, 2025 |

| IPO Listing Date: | June 25, 2025 |

How to Check Arisinfra Solutions IPO Allotment Status?

Investors who applied for Arisinfra Solutions IPO can check their allotment status through 5 different methods: MUFGIntime,NSE website, Demat Account, and Bank Account. Follow the steps below to check your IPO allotment status.

| MUFG Intime: | MUFG Intime IPO Allotment Page |

| BSE: | BSE IPO Allotment Page |

| NSE: | NSE IPO Allotment Page |

| EMI | IPO Allotment Page |

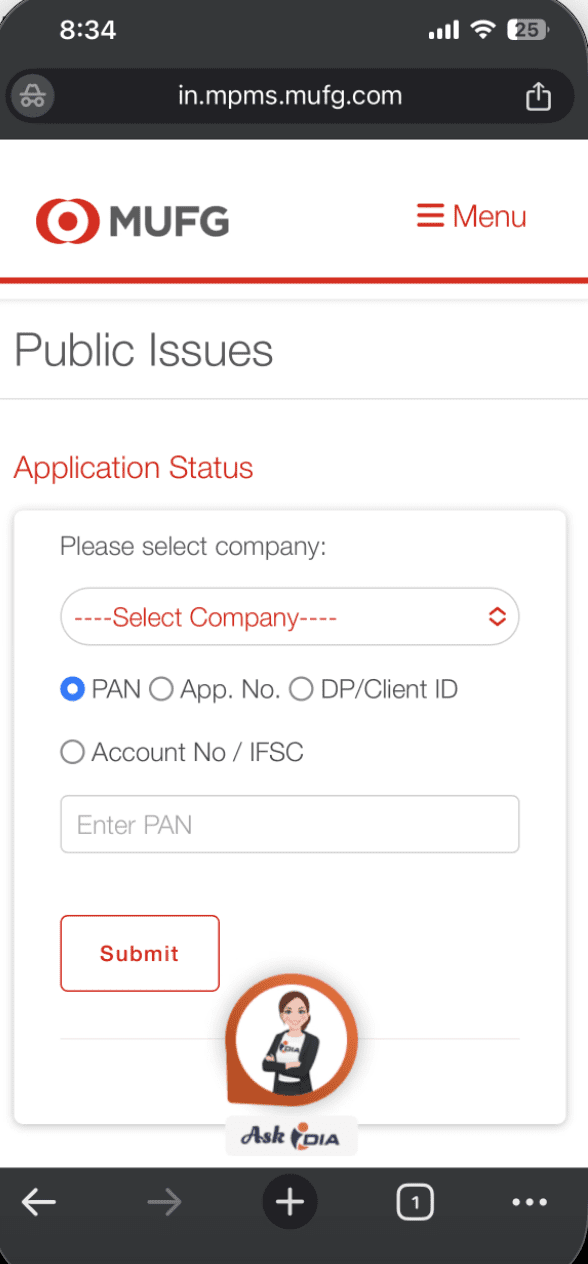

Step 1: How to Check Arisinfra Solutions IPO Allotment Status on Mufgintime?

- Visit the Mufgintime IPO allotment page.

- Select ‘Arisinfra Solutions IPO’ from the drop-down menu.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and the captcha code.

- Click ‘Search’ to view your allotment status

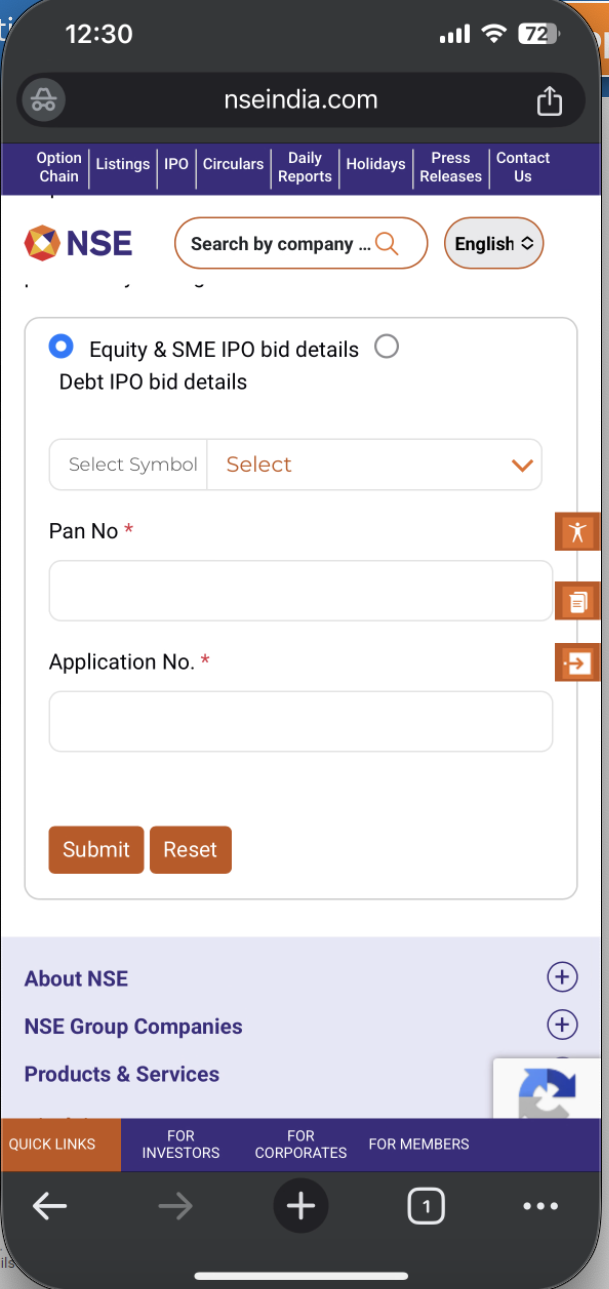

Step 2: How to Check Arisinfra Solutions IPO Allotment Status on NSE?

- Visit the NSE IPO allotment page.

- Select ‘Arisinfra Solutions IPO’ from the list of IPOs.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and captcha code.

- Click ‘Search’ to display your allotment status.

Step 3: How to Check Arisinfra Solutions IPO Allotment in Your Demat Account?

- Log in to your Demat or trading account.

- Navigate to the holdings or portfolio section.

- Check if ‘Arisinfra Solutions IPO’ shares are credited to your account.

- If allotted, the shares will be visible in your holdings.

Step 4: How to Check Arisinfra Solutions IPO Allotment in Your Bank Account?

- Log in to the bank account used for the IPO application.

- Review your account statement or transaction history.

- If shares are allotted, the IPO amount will be debited from your account.

- If not allotted, the blocked amount will be released, and you may receive an SMS or email notification regarding the refund.

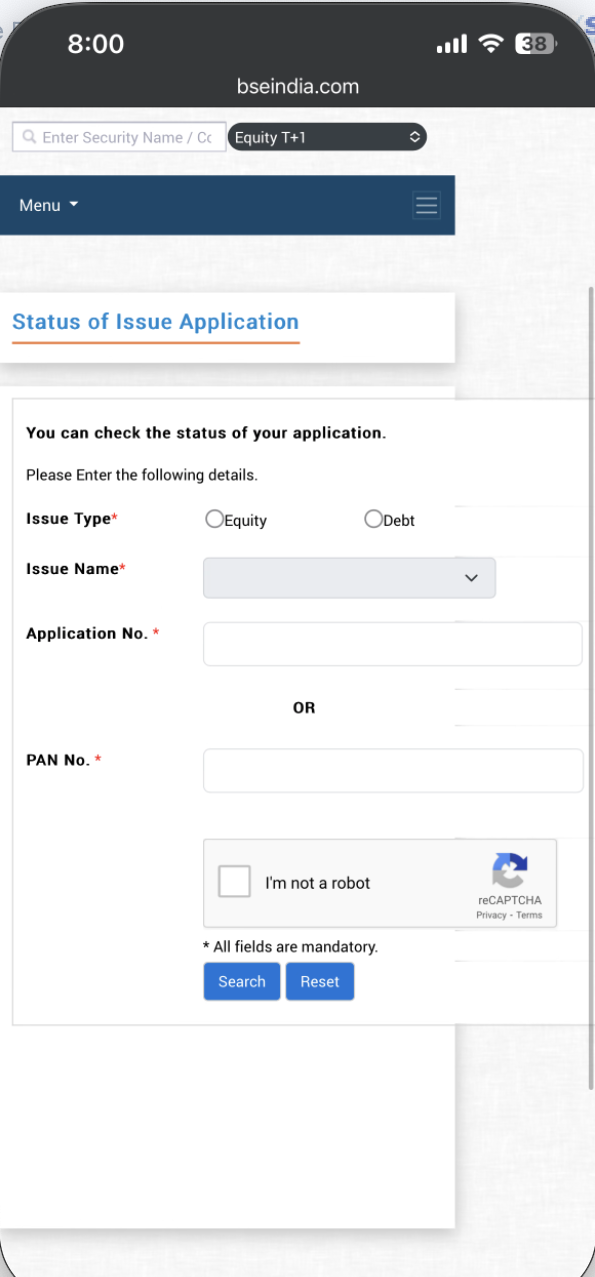

Step 5: How to Check Arisinfra Solutions IPO Allotment Status on BSE?

- Visit the BSE IPO allotment page.

- Select ‘Arisinfra Solutions IPO’ from the list of IPOs.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and captcha code.

- Click ‘Search’ to display your allotment status.

About Company

Incorporated in 2021, ArisInfra Solutions Limited is a pioneering platform designed to streamline the procurement and financial management processes for construction and infrastructure companies. As a business-to-business (B2B) technology-driven company, ArisInfra aims to simplify the construction materials market by digitizing procurement and enhancing the overall customer experience with an efficient end-to-end solution.

The company’s product portfolio includes key construction materials such as GI pipe (Steel), MS Wire (Steel), MS TMT Bar (Steel), OPC Bulk (Cement), and more. Since its inception, ArisInfra has made a significant impact, delivering over 10.35 million metric tonnes of materials between April 1, 2021, and March 31, 2024, which includes a wide range of products like aggregates, ready-mix concrete, steel, cement, construction chemicals, and walling solutions. The company has established partnerships with 1,458 vendors and served 2,133 customers across 963 pin codes, covering major cities such as Mumbai, Bengaluru, and Chennai.

Arisinfra Solutions IPO FAQs

When is the Arisinfra Solutions IPO Allotment Date?

The Arisinfra Solutions IPO allotment is expected to be available on June 23, 2025 (Monday).

What is the Arisinfra Solutions IPO Refund Date?

👉 Refunds for non-allotted applications will be initiated on June 24, 2025 (Tuesday).

How can I check the Arisinfra Solutions IPO Allotment Status?

👉 You can check the allotment status using:

- Your PAN number

- Your application number

- The amount deducted in your bank account.