The NSDL IPO Allotment Status is available now. The IPO subscription had started on July 30, 2025, and ended on August 1, 2025, Friday. The allotment was released on Aug 4, 2025 Monday. after the basis of allotment was finalized.

The investors who applied for the IPO will be able to check the NSDL IPO Allotment Status on the MUFG Intime India Private Ltd website or BSE, NSE website. The IPO GMP went around ₹140 level after the subscription ended.

NSDL IPO Subscription Status

The NSDL IPO received an overwhelming response from investors across all categories, getting subscribed 41.02 times by the end of Day 3, i.e., August 1, 2025, at 5:04 PM.

In the retail investor category, the IPO was subscribed 7.76 times, while the Qualified Institutional Buyers (QIB) segment witnessed a massive oversubscription of 103.97 times, reflecting strong institutional demand. The Non-Institutional Investor (NII) segment was subscribed 34.98 times, with bNII (bids above ₹10 lakh) at 37.73 times and sNII (bids below ₹10 lakh) at 29.47 times.

The anchor investor portion was fully subscribed at 1x with 1,50,17,999 shares allotted, raising ₹1,201.44 crore. Retail investors bid for 13.59 crore shares against the offered 1.75 crore, amounting to around ₹10,876.44 crore. QIBs bid for over 104 crore shares, amounting to ₹83,273.33 crore, while NIIs submitted bids worth ₹21,012.37 crore. The employee quota also saw good participation, with 15.39 times subscription.

Overall, the NSDL IPO saw bids for over 144 crore shares against the 3.51 crore shares on offer, generating a total demand of approximately ₹1.15 lakh crore, highlighting strong interest from all investor segments.

NSDL IPO Dates

| Event | Date (Day) |

| IPO Open Date | July 30, 2025 (Wednesday) |

| IPO Close Date | August 1, 2025 (Friday) |

| Basis of Allotment | August 4, 2025 (Monday) |

| Refunds Initiation | August 5, 2025 (Tuesday) |

| Credit to Demat Account | August 5, 2025 (Tuesday) |

| IPO Listing Date | August 6, 2025 (Wednesday) |

How to Check NSDL IPO Allotment Status?

Investors who applied for NSDL IPO can check their allotment status through 5 different methods: MUFGIntime,NSE website, Demat Account, and Bank Account. Follow the steps below to check your IPO allotment status.

| MUFG Intime: | MUFG Intime IPO Allotment Page |

| BSE: | BSE IPO Allotment Page |

| NSE: | NSE IPO Allotment Page |

| EMI | IPO Allotment Page |

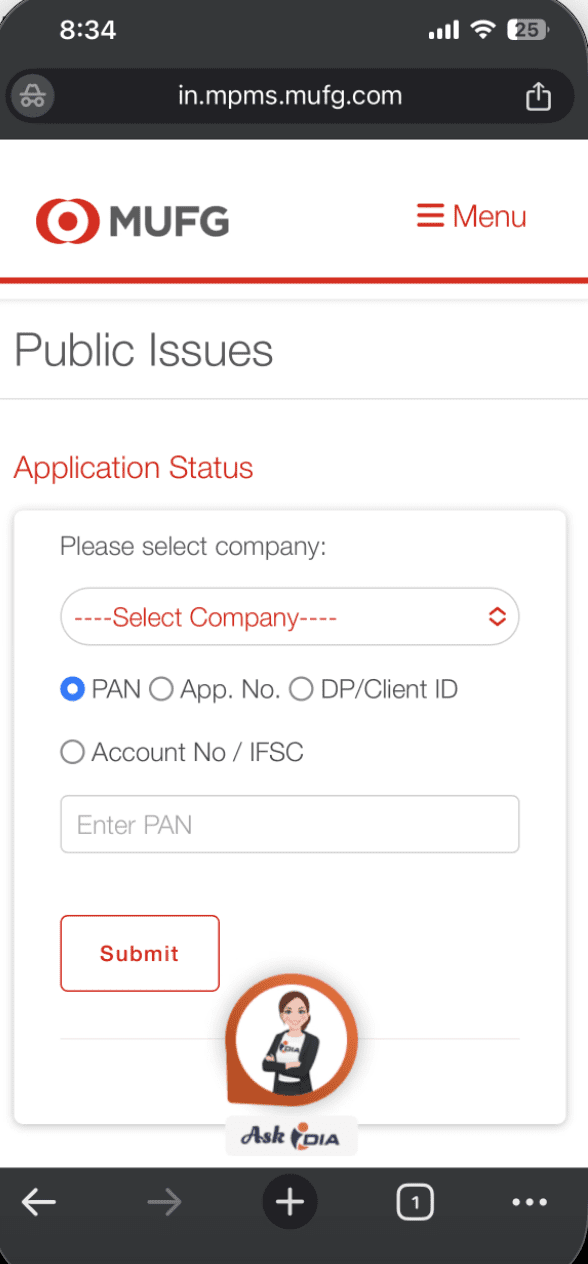

Step 1: How to Check NSDL IPO Allotment Status on Mufgintime?

- Visit the Mufgintime IPO allotment page.

- Select ‘NSDL’ from the drop-down menu.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and the captcha code.

- Click ‘Search’ to view your allotment status

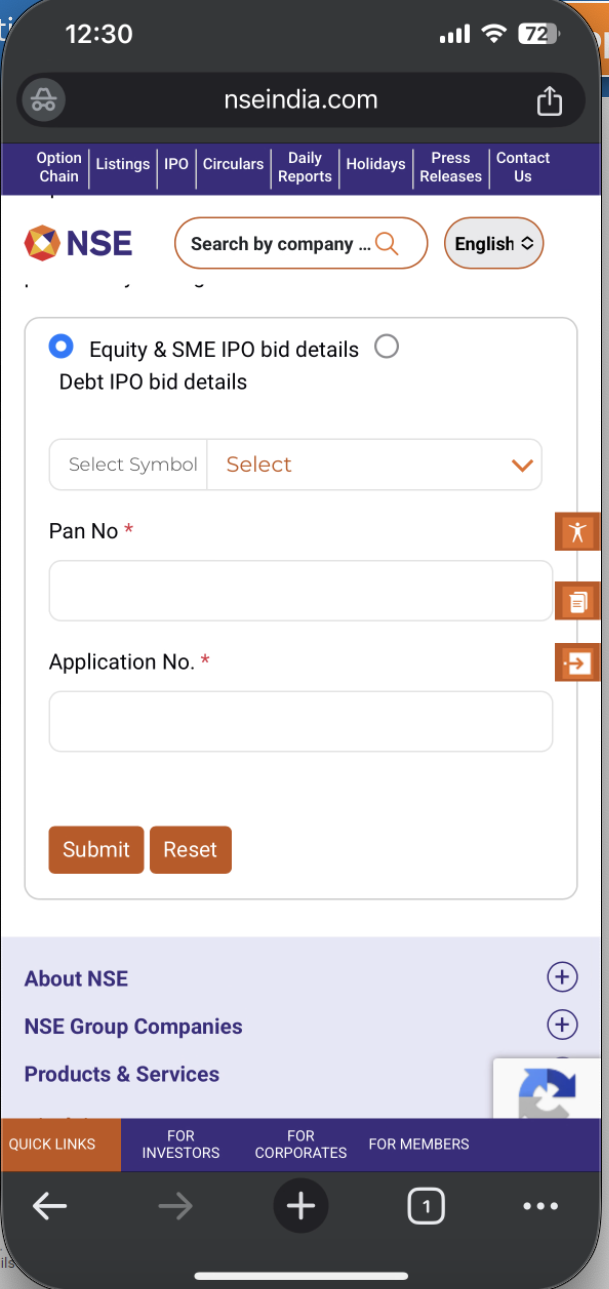

Step 2: How to CheckNSDL IPO Allotment Status on NSE?

- Visit the NSE IPO allotment page.

- Select ‘NSDL IPO’ from the list of IPOs.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and captcha code.

- Click ‘Search’ to display your allotment status.

Step 3: How to Check NSDL IPO Allotment in Your Demat Account?

- Log in to your Demat or trading account.

- Navigate to the holdings or portfolio section.

- Check if ‘NSDL IPO’ shares are credited to your account.

- If allotted, the shares will be visible in your holdings.

Step 4: How to Check NSDL IPO Allotment in Your Bank Account?

- Log in to the bank account used for the IPO application.

- Review your account statement or transaction history.

- If shares are allotted, the IPO amount will be debited from your account.

- If not allotted, the blocked amount will be released, and you may receive an SMS or email notification regarding the refund.

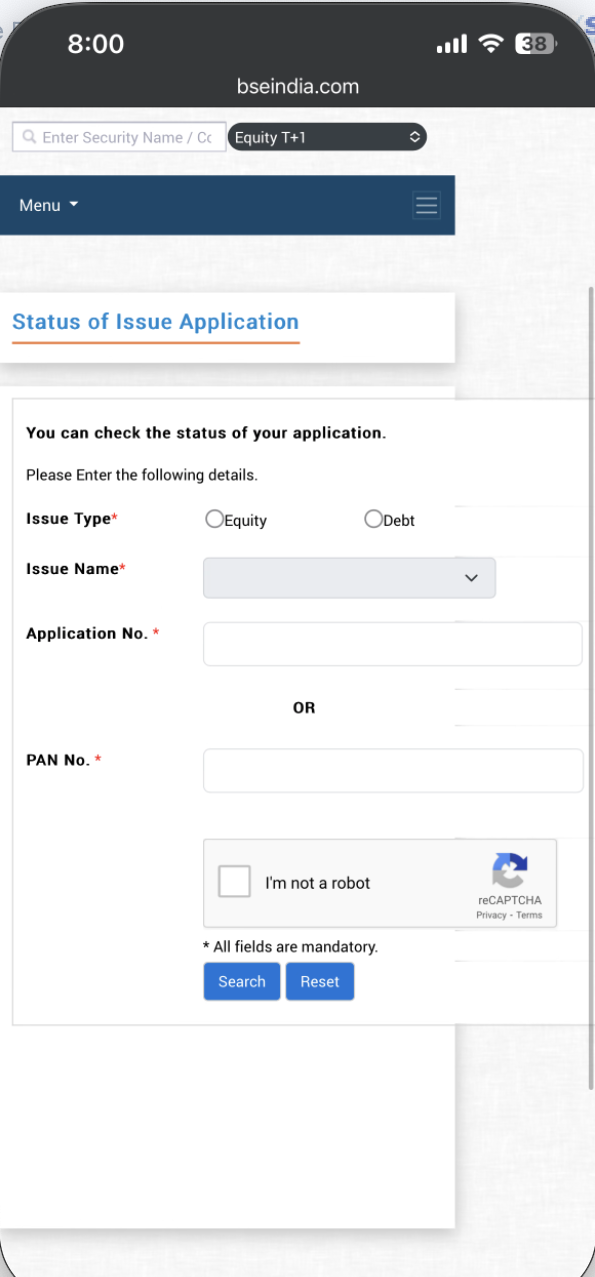

Step 5: How to Check NSDL IPO Allotment Status on BSE?

- Visit the BSE IPO allotment page.

- Select ‘NSDL IPO’ from the list of IPOs.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and captcha code.

- Click ‘Search’ to display your allotment status.

About Company

Established in 1996, the National Securities Depository Limited (NSDL) is one of the world’s largest depositories, playing a pivotal role in India’s capital market infrastructure. It facilitates the holding and settlement of securities in dematerialized form through Demat Accounts, eliminating issues associated with paper-based trading, such as bad deliveries and transfer delays.

NSDL provides services for various asset classes, including equities, mutual funds, debt instruments, sovereign gold bonds, and electronic gold receipts. As of March 31, 2023, it had over 31.46 million active Demat accounts through 283 depository participants, covering more than 99% of India’s pin codes and 186 countries worldwide. It also has 40,987 registered issuers, making it a key player in India’s financial ecosystem.

NSDL IPO Allotment Status FAQs

When is the NSDL IPO Allotment Date?

The NSDL IPO allotment is expected to be available on August 4, 2025 (Monday).

What is the NSDL IPO Refund Date?

👉 Refunds for non-allotted applications will be initiated on August 5, 2025 (Tuesday).

How can I check the NSDL IPO Allotment Status?

👉 You can check the allotment status using:

- Your PAN number

- Your application number

- The amount deducted in your bank account.