The CLN Energy IPO allotment status is available as the basis of allotment is finalized. It is accessible on January 28, 2025. The IPO subscription starts on January 23, 2025, and concludes on January 27, 2025. The shares are scheduled to list on January 30, 2025. Investors who apply for the IPO can check the CLN Energy IPO allotment status online through the Bigshare Services Pvt Ltd website or the BSE website.

CLN Energy IPO Subscription Status

The CLN Energy IPO saw strong investor interest across categories. Anchor Investors and Market Makers subscribed fully, with shares bid matching the offered quantity. Qualified Institutions subscribed 1.07 times, with 3 applications for 5.87 lakh shares.

Non-Institutional Buyers subscribed 8.6 times, bidding for 35.29 lakh shares. Retail Investors showed high enthusiasm, subscribing 6.55 times with 5,966 applications for 62.72 lakh shares. Overall, the IPO was subscribed 5.42 times, with a total of 1.04 crore shares bid, amounting to ₹259.73 crore from 13,907 applications.

CLN Energy IPO GMP

The last GMP for the CLN Energy SME IPO is ₹0, as of January 28, 2025. With a price band of ₹250, the estimated listing price is ₹250 (cap price + today’s GMP), indicating no expected gain or loss per share (0.00%).

Check CLN Energy IPO Allotment Links

| Bigshare: | Bigshare IPO Allotment Page |

| NSE: | NSE IPO Allotment Page |

| Equity Market Insights | IPO Allotment Status Page |

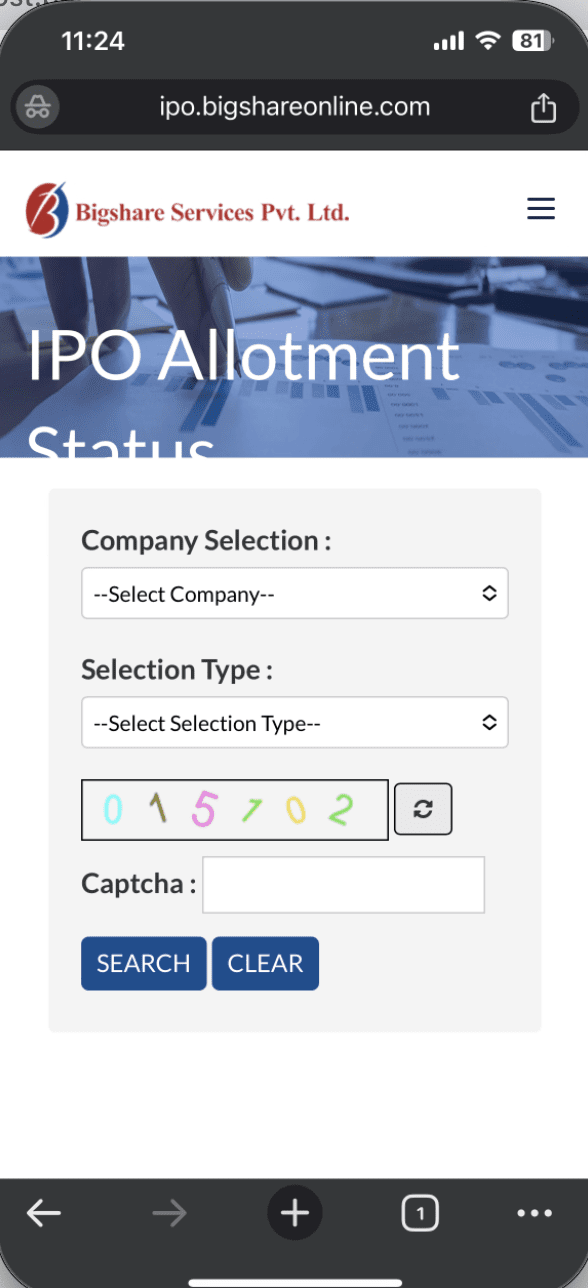

How to Check CLN Energy IPO Allotment Status on Bigshare.com

- Visit the official CLN Energy IPO allotment page on Bigshare (Bigshare.com).

- From the dropdown menu, select CLN Energy.

- Choose your preferred search option: PAN Number, Application Number, or DP ID.

- Enter the required details based on your selection.

- Click the Search button.

- Your IPO allotment status will be displayed on the screen.

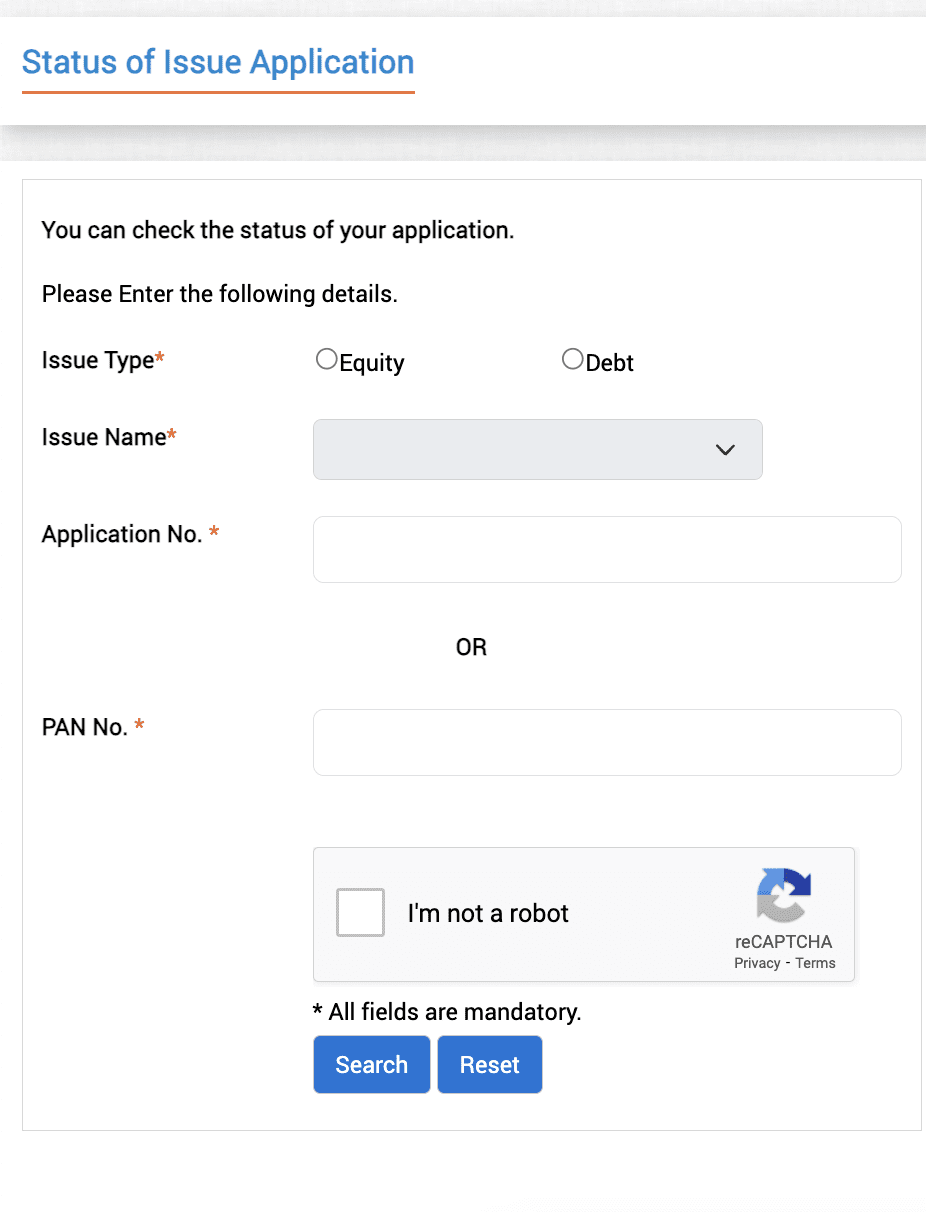

How to Check CLN Energy IPO Allotment Status on BSE

- Navigate to the BSE IPO allotment page (BSEIndia.com).

- From the dropdown menu, select CLN Energy.

- Choose the search method: PAN Number, Application Number, or DP ID.

- Enter the required information based on your choice.

- Click the Search button.

- Your allotment status will appear on the screen.

How to Check CLN Energy IPO Allotment in Your Demat Account

- Contact your broker or log into your Demat Account or Trading Account.

- Verify if the IPO shares have been credited to your account.

- If shares are allotted, they will be visible in your Demat account.

How to Check CLN Energy IPO Allotment in Your Bank Account

- Log into the Bank Account from which you applied for the IPO.

- Navigate to the Balance Tab.

- If shares are allotted, the amount will be debited from your bank account.

- If no allotment is received, the amount will be refunded to your account.

- In case of allotment, you will also receive an SMS notification, such as: “Dear Customer, [Bank Name] Account [Account Number] is debited with INR [Amount] on [Date]. Info: CLN Energy IPO. The Available Balance is INR [Remaining Amount].”

IPO Dates

| Event | Date |

|---|---|

| IPO Opening Date | Thursday, January 23, 2025 |

| IPO Closing Date | Monday, January 27, 2025 |

| Basis of Allotment Finalization | Tuesday, January 28, 2025 |

| Refunds Initiated | Wednesday, January 29, 2025 |

| Shares Credited to Demat Accounts | Wednesday, January 29, 2025 |

| Listing Date | Thursday, January 30, 2025 |

| UPI Mandate Confirmation Deadline | 5 PM on January 27, 2025 |

About Company

CLN Energy Limited, founded in 2019, is a leading manufacturer of customized lithium-ion batteries, motors, and powertrain components for electric vehicles (EVs) and stationary applications like solar power and energy storage systems.

With ISO certifications and manufacturing facilities in Noida and Pune, the company produces over 1GWh of battery packs and 120,000 motors annually. Employing 155 permanent and 286 contract workers, CLN Energy is known for its experienced team, in-house R&D, and strong customer relationships. Its strong financials and strategic market positioning make the CLN Energy IPO an attractive investment opportunity in the growing clean energy sector.