In the world of stock market trading, understanding price movements and predicting future trends is crucial for making profitable decisions. One of the most popular and time-tested technical analysis tools used by traders is the Fibonacci Retracement Strategy.

This strategy helps identify key levels where a stock price might reverse or take a pause during its upward or downward trend. Derived from the famous Fibonacci sequence, these retracement levels act as invisible support and resistance zones in the stock market.

Many experienced traders use Fibonacci retracement to plan their entry, exit, and stop-loss points, making it an essential tool for both beginners and professionals looking to maximize their profits. Whether you’re a day trader or a long-term investor, knowing how to apply this strategy can give you an edge in the highly unpredictable stock market.

Overview of Contents

What is Fibonacci Retracement?

In stock market trading, predicting price movements is never an easy task. However, certain tools help traders get closer to identifying potential price reversal points — and one such powerful tool is the Fibonacci Retracement Strategy. This strategy is widely used by traders to identify important levels where a stock price might pause, reverse, or continue its trend.

The Fibonacci Retracement is based on the Fibonacci sequence, a mathematical pattern discovered by Italian mathematician Leonardo Fibonacci. While this sequence is commonly seen in nature and architecture, it has found its place in financial markets due to its unique way of predicting price movements.

The retracement tool helps traders measure how much of the previous price movement will likely pull back before continuing its original trend. The most commonly used Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels act as invisible support and resistance zones where price corrections often happen.

Why Do Traders Use Fibonacci Retracement in the Stock Market?

In any stock market trend, prices never move in a straight line. After a big rally or sharp decline, the price usually retraces or pulls back before continuing its journey. This is where Fibonacci Retracement becomes helpful — it helps traders identify those zones where the price might bounce back or consolidate.

For example, if a stock moves from ₹100 to ₹200, the price might retrace to certain Fibonacci levels like:

- 23.6% – ₹176.4

- 38.2% – ₹161.8

- 50% – ₹150

- 61.8% – ₹138.2

If the stock price starts bouncing back from ₹161.8 (38.2%) or ₹150 (50%), it indicates that buyers are entering the market — making it a perfect point for buying opportunities.

How to Use Fibonacci Retracement in Trading

Identifying Market Trends

The first and most crucial step in using Fibonacci retracement is to identify the prevailing market trend. Traders need to determine whether the asset is in an uptrend or downtrend before applying the retracement tool.

- In an uptrend, the retracement should be drawn from the recent low to the recent high.

- In a downtrend, the retracement is drawn from the recent high to the recent low.

Accurately identifying the trend helps traders mark the price range where the Fibonacci levels will be applied, making it easier to spot potential pullback zones.

Drawing Fibonacci Levels

Most trading platforms like TradingView, MetaTrader, or Zerodha Kite provide built-in Fibonacci retracement tools that automatically draw retracement levels on the chart.

To draw Fibonacci levels:

- Select the Fibonacci retracement tool from the charting platform.

- Click on the recent swing low and drag it to the swing high in an uptrend (or vice versa in a downtrend).

- The tool will automatically plot the key retracement levels: 23.6%, 38.2%, 50%, 61.8%, and 100%.

These levels act as potential support and resistance zones, helping traders understand where the price might reverse or consolidate.

Analysing Price Action

Once the Fibonacci levels are plotted, traders need to observe how the price reacts near these levels. However, relying solely on Fibonacci retracement can be risky. Therefore, it’s important to combine it with other technical indicators like:

- Moving Averages to confirm trend direction

- RSI (Relative Strength Index) to identify overbought or oversold conditions

- Candlestick Patterns like Doji or Hammer

- Volume Spikes to validate breakouts or reversals

- By combining these tools, traders can filter out false signals and improve their chances of making profitable trades.

Setting Entry and Exit Points

Fibonacci retracement helps traders set precise entry and exit points. Here’s how:

- In an uptrend, traders can look to buy near the 38.2% or 50% retracement levels if the price shows signs of bouncing back.

- In a downtrend, traders can enter short positions near the 38.2% or 50% retracement levels when the price starts falling again.

Profit targets can be set at higher Fibonacci levels like 61.8% or 100% in uptrends and lower levels in downtrends.

Risk Management

One of the biggest advantages of Fibonacci retracement is its role in risk management. Traders can place stop-loss orders just below or above key retracement levels to limit potential losses.

For example:

- If a trader enters at the 50% retracement level, they can place a stop-loss order just below the 61.8% level.

- This strategy protects capital while allowing room for price fluctuations.

6. Applying Fibonacci to Different Time Frames

Fibonacci retracement works across various time frames, making it suitable for different trading styles:

- Day Traders prefer short time frames like 15-minute or hourly charts.

- Swing Traders use daily or weekly charts to identify long-term price movements.

- Investors might apply Fibonacci retracement on monthly charts to understand broader market trends.

By adjusting the time frames, traders can customize the Fibonacci retracement tool according to their strategy and market horizon.

Advanced Strategies for Trading with Fibonacci Retracement Levels

Fibonacci Retracement levels are essential tools used by traders to predict potential support and resistance zones during market corrections. These levels are derived from the Fibonacci sequence, a mathematical pattern that appears frequently in nature and financial markets. The key retracement levels provide insights into possible price reversal points within a trend. Below is a detailed explanation of these levels and their significance.

1. 23.6% Retracement Level

This level is regarded as a minor correction in the ongoing trend, often indicating that the market momentum remains strong. When the price retraces to this shallow level, it suggests that buyers or sellers are still in control, and the price is likely to resume the primary trend quickly. Aggressive traders often look for bounce-back signals at this point to enter trades early.

2. 38.2% Retracement Level

The 38.2% level signals a more substantial pullback, indicating a healthy correction without disrupting the overall trend. It often serves as a crucial support or resistance zone, where the price might consolidate before continuing the trend. Many traders wait for confirmation patterns like candlestick formations or volume spikes at this level before making their entry decisions.

3. 50% Retracement Level

Though not a Fibonacci-derived level, the 50% retracement is widely observed by traders. It signifies a balanced pullback where buying and selling pressures are relatively equal. This level often acts as a psychological barrier where market participants reassess their positions. Traders frequently set entry points, stop-loss orders, or partial profit targets at this level.

4. 61.8% Retracement Level

Known as the Golden Ratio, the 61.8% retracement level is one of the most significant Fibonacci levels in trading. It represents a deep correction where price reversals are highly probable. This level is often associated with strong buying or selling pressure. Traders tend to place entry orders at this level, accompanied by tight stop-loss placements, due to the increased likelihood of trend continuation.

5. 100% Retracement Level

The 100% retracement level marks a complete reversal of the initial price move. When the price retraces fully to its starting point, it signals the exhaustion of the current trend. Traders use this level to identify potential trend reversals or to re-evaluate their trading strategies. Breakouts beyond this level often indicate the formation of a new trend.

Understanding Fibonacci Retracement levels is crucial for identifying market corrections and potential price reversals. By combining these levels with other technical analysis tools, traders can improve their decision-making process and enhance their overall trading strategies. Whether used for setting entry points, managing risk, or confirming trends, Fibonacci Retracements remain a valuable component in any trader’s toolkit.

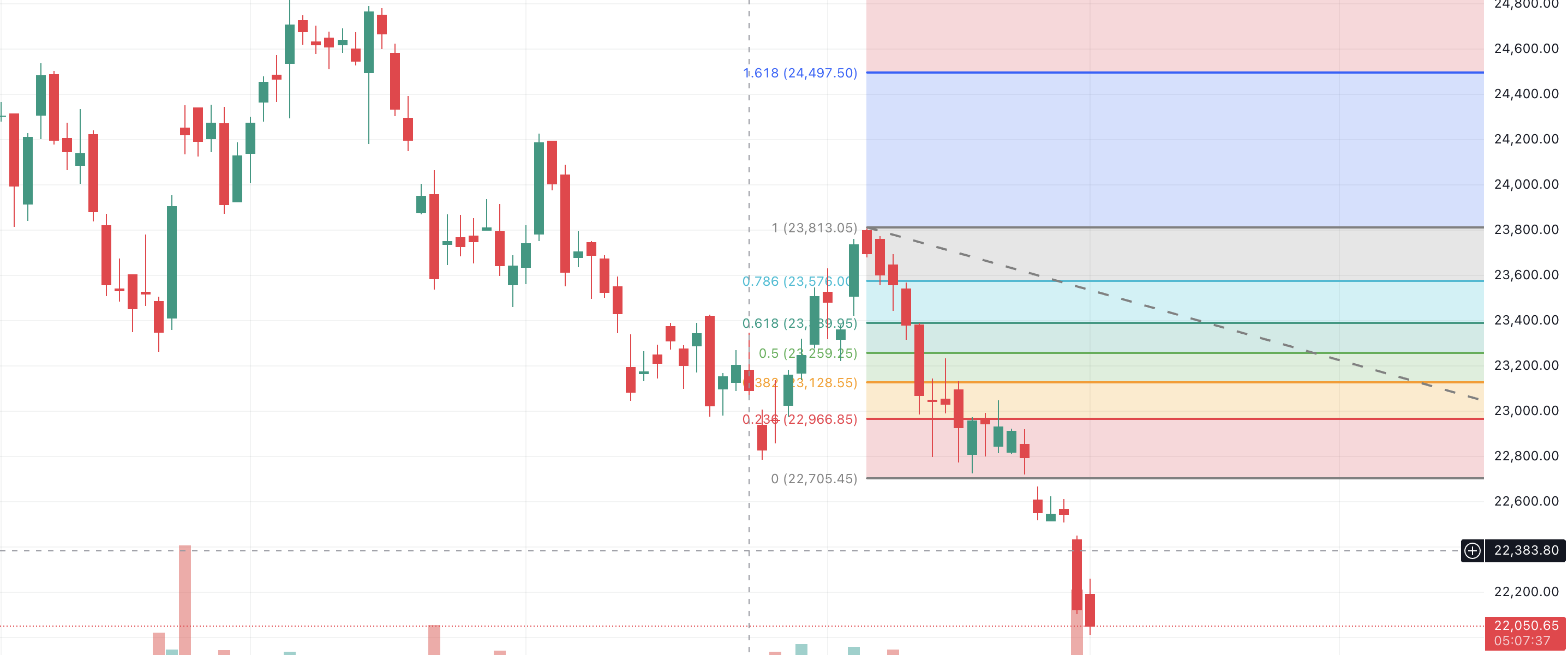

Fibonacci Retracement in Downtrend with Examples

In a downtrend, Fibonacci Retracement levels help traders identify potential resistance zones where the price may reverse or consolidate before continuing its decline. As illustrated in the images provided, the retracement is drawn from the recent high (swing high) to the recent low (swing low).

Step 1: Identify the downward trend by locating the highest peak and the lowest point of the price movement.

- Step 2: Apply the Fibonacci Retracement tool from the swing high to the swing low. The levels such as 23.6%, 38.2%, 50%, 61.8%, and 100% will automatically appear on the chart.

- Step 3: The price may retrace to any of these levels before resuming the downtrend. The 38.2% and 61.8% levels often act as strong resistance zones.

- Step 4: Observe the price action at these levels and use additional technical indicators such as RSI, MACD, or volume patterns to confirm potential reversals.

- Step 5: Enter short positions at the resistance levels with stop-loss orders placed above the next Fibonacci level.

The accompanying images visually demonstrate how to plot Fibonacci Retracement levels on a downtrend graph, making it easier for traders to identify key resistance points and make informed trading decisions.

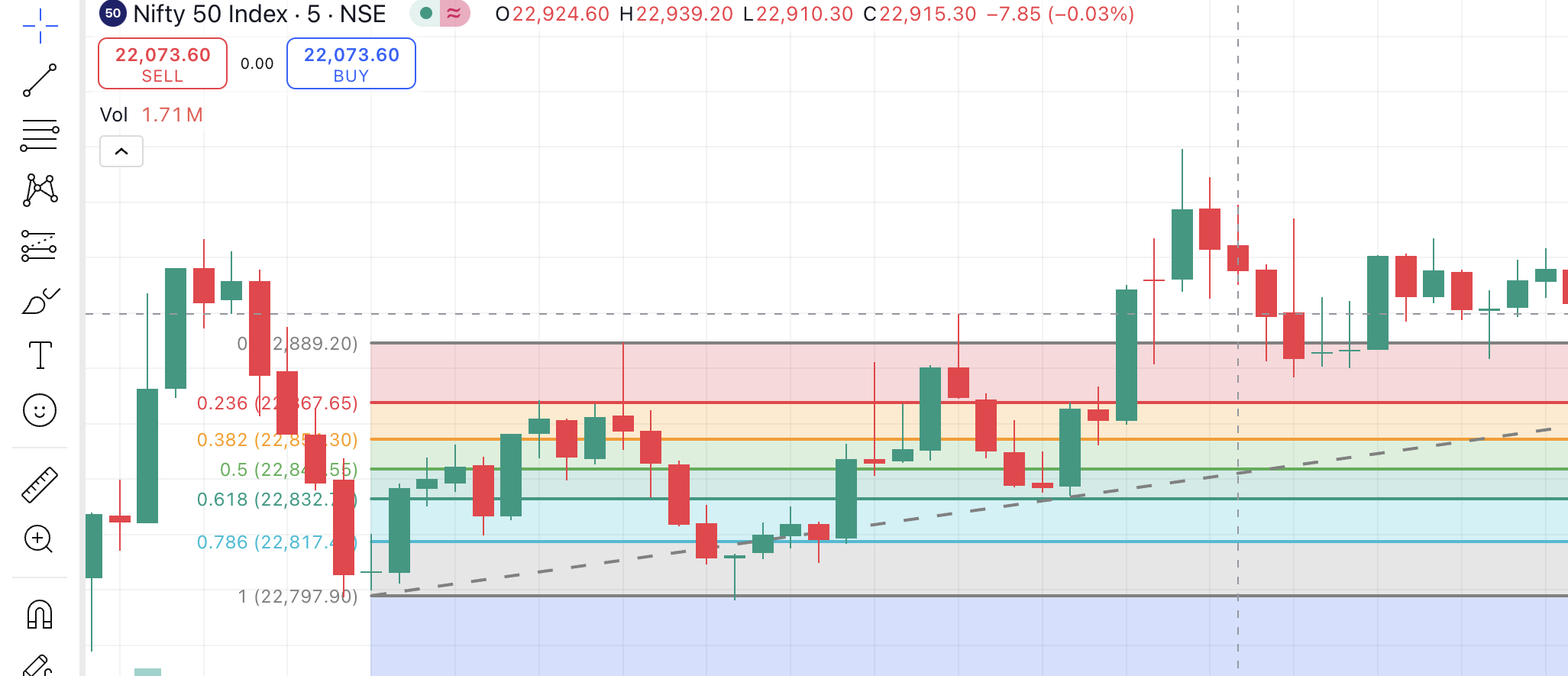

Fibonacci Retracement in Upside with Examples

When analysing an upside trend using Fibonacci Retracement, traders can identify key levels to determine potential support and resistance points. Below is a step-by-step explanation with graphical insights on how to draw Fibonacci retracement levels in an upward trend.

in an upside trend, the price consistently makes higher highs and higher lows. The first step is to identify the recent significant low (swing low) and the highest point (swing high). The Fibonacci retracement will be drawn from the swing low to the swing high to map out possible support levels where the price might retrace before continuing upward.

How Does Fibonacci Play a Crucial Role ?

Fibonacci holds significant importance in financial markets as it provides traders with a structured method to predict price movements and identify crucial reversal levels. Derived from the famous Fibonacci sequence (0, 1, 1, 2, 3, 5, 8, 13, 21, and so on), this mathematical concept forms the backbone of many technical analysis strategies. The ratios derived from this sequence, particularly 38.2%, 50%, and 61.8%, act as essential markers for identifying potential support and resistance levels in price charts.

The relevance of Fibonacci retracement levels lies in their ability to highlight psychological price zones where market participants may react. These levels represent points where the price might temporarily pause, reverse, or consolidate before continuing its trend. For example, in an uptrend, the price may retrace to a Fibonacci level such as 38.2% or 50%, where buying pressure could emerge, pushing the price back up. Conversely, in a downtrend, these levels may act as resistance zones, preventing the price from rising further.

Fibonacci analysis helps traders make informed decisions by offering a systematic way to determine entry and exit points. It also assists in risk management, as traders can place stop-loss orders around these levels to limit potential losses. Additionally, combining Fibonacci retracement with other technical tools like candlestick patterns, moving averages, and volume analysis enhances its accuracy, making it a powerful method for predicting price behavior in various financial markets.

Exploring Fibonacci Extensions in Technical Analysis

Fibonacci Extensions serve as an essential tool in technical analysis, offering traders a method to forecast future price targets beyond the standard retracement levels. These extensions are particularly useful in strong trending markets, helping traders predict where the price might reach after a retracement phase.

Derived from the Fibonacci sequence, key extension levels include 127.2%, 161.8%, and 261.8%. These levels act as potential price targets, enabling traders to set profit-taking zones and strategic stop-loss orders. The process begins by identifying a significant price movement and measuring the retracement. Once the price resumes its trend, Fibonacci Extensions project how far the price may advance.

For instance, if a stock retraces to the 50% or 61.8% Fibonacci retracement level and then continues its upward momentum, traders can look to the 161.8% extension as a possible target for exiting positions. This method not only helps maximize profits but also enhances risk management by offering predefined exit points.

Combining Fibonacci Extensions with other technical indicators, such as moving averages or trendlines, can further improve accuracy and provide a comprehensive market analysis. These extensions act as powerful tools for traders seeking to capitalize on market momentum and make informed trading decisions.

FAQs

What is Fibonacci Retracement?

Fibonacci retracement is a technical analysis tool that helps traders identify potential support and resistance levels based on the Fibonacci sequence.

How to Identify Fibonacci Levels?

Fibonacci levels are identified by selecting two significant price points, typically a high and a low, and applying the Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 100%) to determine possible retracement levels.

Why is 61.8% Called the Golden Ratio?

The 61.8% level is referred to as the golden ratio because it frequently appears in nature and financial markets, indicating a strong likelihood of price reversal.

How to Use Fibonacci for Entry Points?

Traders use Fibonacci retracement levels to identify potential entry points by observing price action at key retracement levels, confirming with other technical indicators.

What is Fibonacci Extension?

Fibonacci extension projects potential price targets beyond the standard retracement levels, commonly used to set profit targets in trending markets.

Can Fibonacci Levels Predict Market Trends?

While Fibonacci levels do not guarantee market predictions, they offer valuable insights into potential price movements and help traders make informed decisions.

Which Time Frames Work Best with Fibonacci?

Fibonacci retracement can be applied across various time frames, but it is most effective on longer time frames like daily, weekly, or hourly charts.

Is Fibonacci Strategy Reliable?

The Fibonacci strategy is widely used by traders, but its reliability increases when combined with other technical analysis tools and market research.