The Leo Dryfruits IPO allotment status is now live and available! Investors who participated in the IPO can check their allotment status starting today, January 6, 2025. Visit the official Bigshare Services Private Limited website or the BSE platform to view the details

The subscription for the Leo Dryfruits IPO closed on January 3, 2025, with an overwhelming response, as the IPO was subscribed 181.77 times overall. The IPO’s grey market premium (GMP) stood at approximately ₹18 post-subscription.

The price band for the IPO is ₹51 to ₹52 per share, with investors eligible to apply in multiples of 2,000 shares. To verify their IPO allotment status, applicants can follow the easy steps available on either the BSE website or through the IPO registrar, Bigshare Services Pvt Ltd. This IPO offers a significant opportunity for investors, with strong demand and a promising subscription rate.

Overview of Contents

Leo Dryfruits IPO Subscription Status

The Leo Dryfruits IPO saw a remarkable subscription of 181.77x by 5:00 PM on January 3, 2025, with significant participation across all investor categories.

The Qualified Institutional Buyers (QIB) portion was subscribed 68.08x, the Non-Institutional Investors (NII) portion was subscribed 394.59x, and Retail Individual Investors (RII) subscribed 154.5x.

The IPO received bids for 59,25,62,000 shares against the 32,60,000 shares on offer. The IPO had strong subscription on all three days, with 3.02x on Day 1 and 14.15x on Day 2.

Check Leo Dryfruits IPO Allotment Links

| Bigshare: | Bigshare IPO Allotment Page |

| NSE: | NSE IPO Allotment Page |

| Equity Market Insights | IPO Allotment Status Page |

Step 1: How to Check ‘Leo Dryfruits’ IPO Allotment Status on Bigshare?

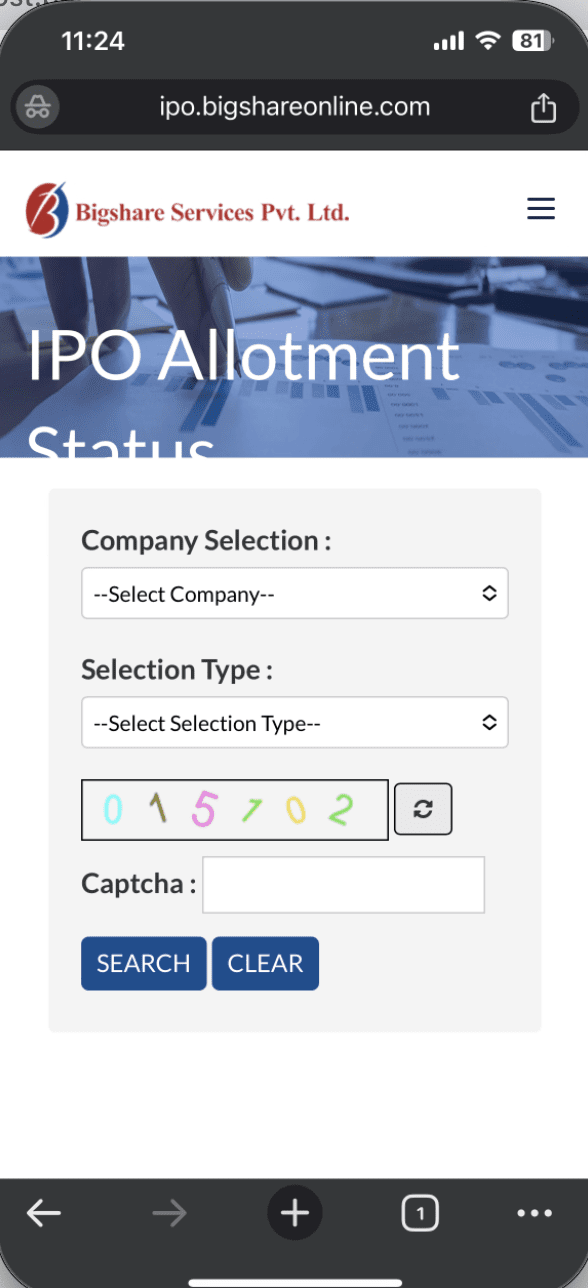

To check the Leo Dryfruits IPO allotment status on Bigshare, follow these steps:

- Visit the official Leo Dryfruits IPO allotment page on Bigshare’s website.

- Select ‘Leo Dryfruits’ from the drop-down menu.

- Choose the search option based on your preference: PAN Number, Application Number, or Demat Account Number.

- Enter the required details (PAN, Application Number, or Demat Account Number).

- Click the ‘Search’ button.

- Your allotment status will appear on the screen, accessible via both mobile and desktop.

Step 2: How to you check Leo Dryfruits IPO Allotment Status on BSE?

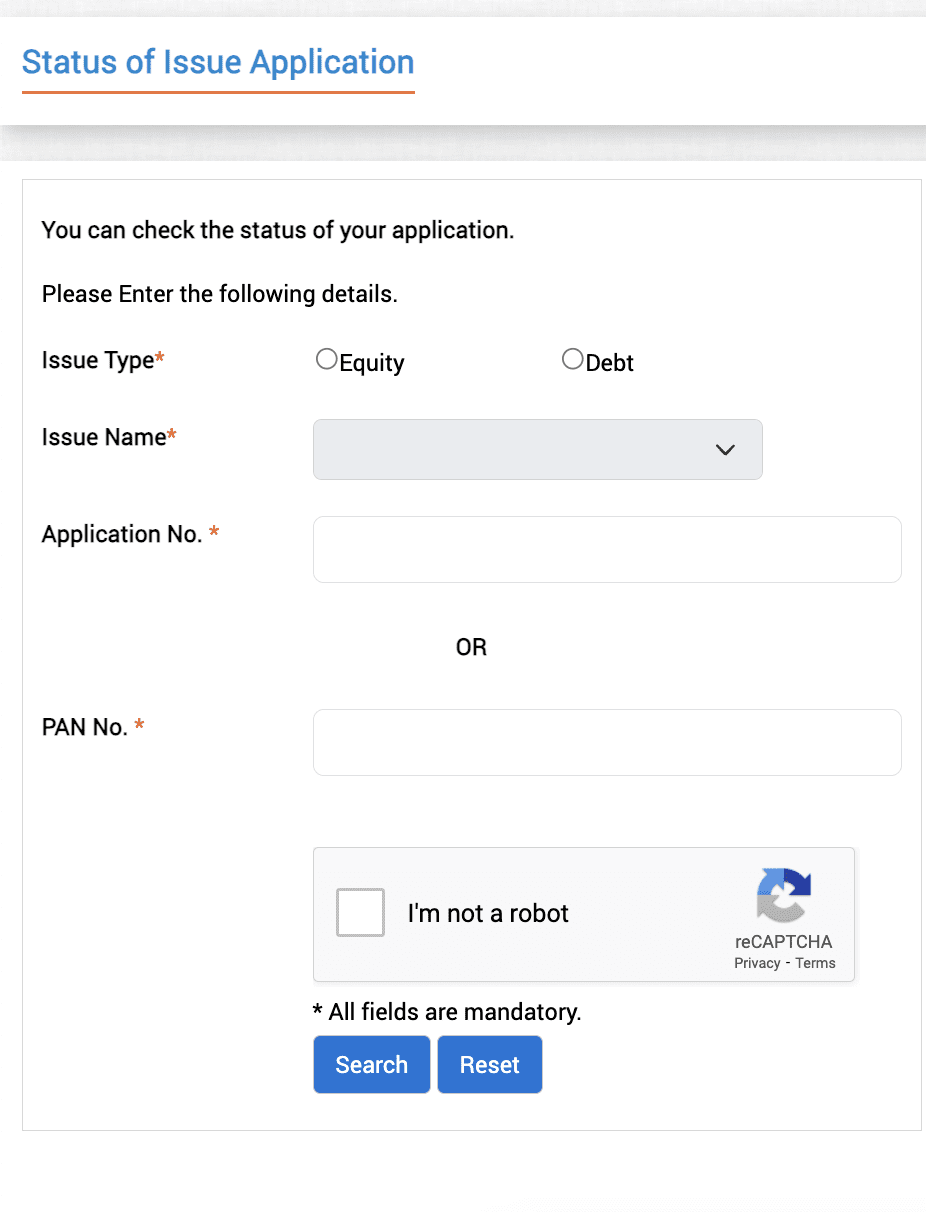

To check the Leo Dryfruits IPO allotment status on BSE:

- Go to the official IPO allotment page on the BSE website.

- Select ‘Leo Dryfruits’ from the drop-down menu.

- Choose the appropriate option: PAN Number, Application Number, or Demat Account Number.

- Enter the selected details (PAN, Application Number, or Demat Account Number).

- Click the ‘Search’ button.

- Your allotment status will be displayed on the screen for easy viewing.

Step 3: How to you check Leo Dryfruits IPO Allotment in the Demant Account?

To check if your shares have been allotted, follow these steps:

- Contact your broker or log in to your Demat/Trading account.

- Check if the allotted shares are credited to your Demat account.

- If allotted, you will see the shares in your account balance.

Step 4: How to you check Leo Dryfruits IPO Allotment in a Bank Account?

To verify the allotment status via your bank account:

- Log in to the bank account from which you applied for the Leo Dryfruits IPO.

- Navigate to the Balance Tab.

- If you have been allotted shares, the corresponding amount will be debited from your account.

- If you have not been allotted shares, the amount will be refunded.

- Upon allotment, you will receive an SMS notification, such as: “Dear Customer, Bank Name Account 00001 is debited with INR 00000.00 on Date. Info: Leo Dryfruits IPO. The Available Balance is INR 000000.”

Leo Dryfruits IPO Dates

| IPO Open Date | Wednesday, January 1, 2025 |

| IPO Close Date | Friday, January 3, 2025 |

| Basis of Allotment | Monday, January 6, 2025 |

| Initiation of Refunds | Tuesday, January 7, 2025 |

| Credit of Shares to Demat | Tuesday, January 7, 2025 |

| Listing Date | Wednesday, January 8, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on January 3, 2025 |

About Company

Leo Dryfruits & Spices Trading Limited, established in 2019, is a prominent manufacturer and trader of spices, dry fruits, and grocery products under the brands “VANDU” and “FRYD.”

The company offers a diverse range of products, including spices, dry fruits, ghee, and seasonings. With a 71% revenue growth and an 83% increase in profit after tax for FY 2024, Leo Dryfruits operates from Thane, Maharashtra, and employs around 46 staff.

Leo Dryfruits IPO Allotment Status FAQs

When is the Leo Dryfruits IPO Allotment Date?

The Leo Dryfruits IPO allotment will be available on January 6, 2025.

How to Check Leo Dryfruits IPO Allotment Status?

You can check the allotment status on the Bigshare website or the BSE website by entering your PAN number, application number, or Demat account details.

Where to Check Leo Dryfruits IPO Allotment Status?

The allotment status can be checked on Bigshare Services Pvt Ltd or BSE India websites.

What to Do if I Am Allotted Shares in Leo Dryfruits IPO?

If allotted, shares will be credited to your Demat account, and the IPO amount will be debited from your bank account.

How Do I Know if I Have Been Allotted Shares?

You can verify through your Demat account, your bank account, or by checking the IPO allotment status on Bigshare or BSE websites.

When Will the Refunds Be Processed for Non-Allottees?

Refunds for non-allottees will be processed after the allotment, likely by January 6, 2025.