The Rajesh Power IPO has created quite a buzz in the market with an overwhelming response. The IPO was subscribed 59.00 times overall, showing tremendous market confidence. While the basis of allotment is yet to be finalized, the Rajesh Power IPO Allotment Status will be available on December 2nd. If you applied for the Rajesh Power IPO, here’s a detailed guide on how to check the allotment status both online and offline.

Rajesh Power IPO Subscription Details

The IPO witnessed strong demand across all categories, with the total subscription standing at 59 times. Specifically, the NII segment was oversubscribed by 138.46 times, while the QIB portion was oversubscribed by 46.39 times, and the retail portion by 31.96 times. The IPO price range was between ₹319 and ₹335 per share, with a total fund raise of ₹160.47 crore, including 27.90 lakh fresh shares worth ₹93.47 crore and an Offer for Sale (OFS) of 20 lakh shares. The IPO attracted 1,55,371 applications, and investors applied for 18,96,20,000 shares, compared to the 32,09,600 shares on offer.

| Parameter | Details |

|---|---|

| IPO Subscription | 59.00 times overall |

| NII Segment | Oversubscribed 138.46 times |

| QIB Portion | Oversubscribed 46.39 times |

| Retail Portion | Oversubscribed 31.96 times |

| IPO Price | ₹319 to ₹335 per share |

| Total Fund Raised | ₹160.47 crore |

| Fresh Shares | 27.90 lakh shares worth ₹93.47 crore |

| Offer for Sale (OFS) | 20 lakh shares |

| Number of Applications | 1,55,371 |

| Total Shares Applied | 18,96,20,000 shares (against 32,09,600 shares on offer) |

Check Rajesh Power IPO Allotment Status

You can check the Enviro Infra IPO allotment status on the following platforms:

| Bigshare | Allotment Status |

| BSE | Allotment Status |

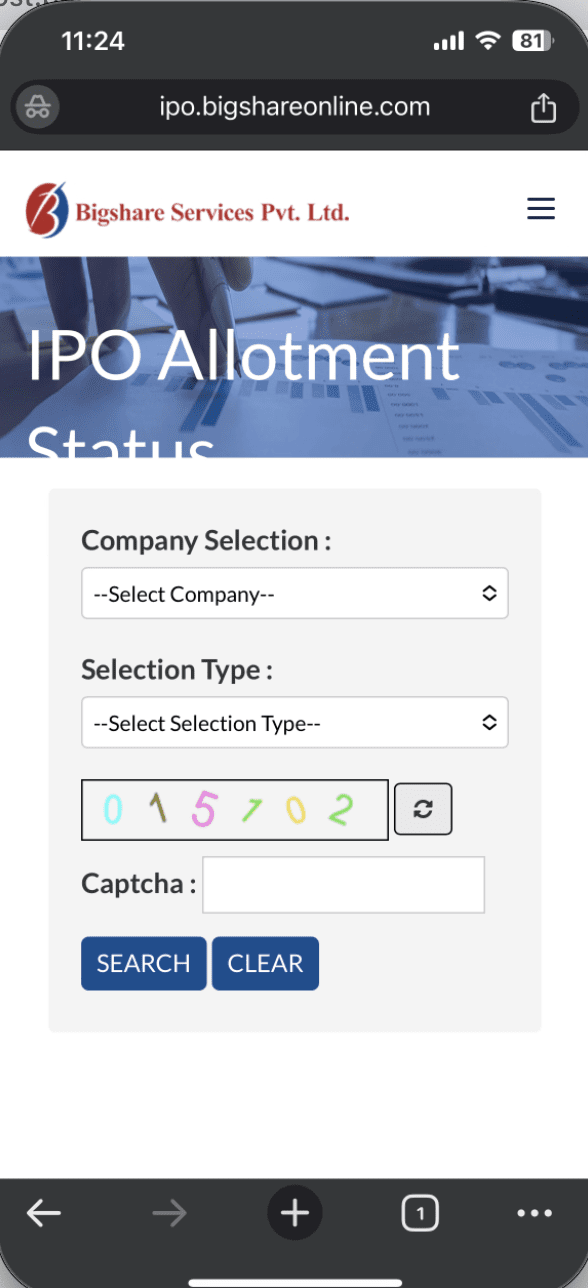

Step I: How to Check Rajesh Power IPO Allotment on Bigshare:

- Visit Bigshare IPO Allotment Page: Bigshare IPO Allotment Page.

- Select IPO Name: Choose ‘Rajesh Power’ from the drop-down menu.

- Choose an Option: You can select one of the following options to check the allotment:

- PAN Number

- Application Number

- Demat Account Number (DP ID)

- Enter Details: Based on your selection, enter the appropriate details.

- Click ‘Search’: Hit the search button to view your allotment status.

- View Allotment: The allotment status will be displayed on your screen (mobile/desktop).

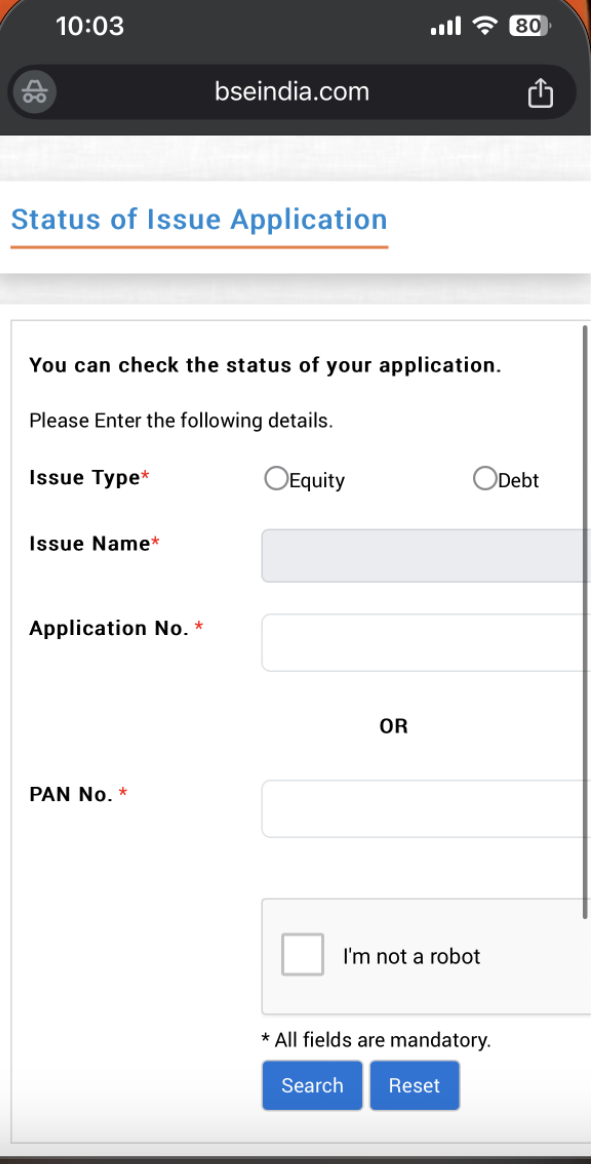

Step II: How to Check Rajesh Power IPO Allotment on BSE:

- Visit BSE IPO Allotment Page: BSE IPO Allotment Page.

- Select IPO Name: Choose ‘Rajesh Power’ from the drop-down menu.

- Select Option: Choose between PAN Number, Application Number, or DP ID.

- Enter Required Details: Based on your selection, input the necessary details.

- Click ‘Search’: Press the search button to find out the allotment status.

- View Allotment: Check your allotment status on your screen.

Step III: Check Rajesh Power IPO Allotment in Your Demat Account:

- Contact Your Broker or log in to your Demat/Trading Account.

- Check if Shares Are Credited: If you’ve been allotted shares, they will appear in your Demat account.

- Confirm Allotment: If shares are not credited, it means you didn’t get the allotment.

Step IV: Check Rajesh Power IPO Allotment in Your Bank Account:

- Login to Bank Account: Use the same bank account from which you applied for the Rajesh Power IPO.

- Check Balance Tab: If you got the allotment, the amount will be debited from your account.

- Check SMS Notifications: If you received the allotment, you will receive an SMS notifying you about the debit from your bank account, confirming the IPO allotment.

Conclusion

The Rajesh Power IPO has garnered immense attention with a subscription of 59 times, and the allotment status is eagerly awaited. Investors can check their allotment status on Bigshare and BSE websites or through their Demat and Bank Accounts. Keep in mind that the allotment status will be available starting December 2nd, so be sure to follow the steps outlined above to check your status.

FAQs

When will the allotment status be available?

The allotment status will be available on December 2nd.

Can I check the allotment in my Demat account?

Yes, log in to your Demat account to check if the shares are credited.

How to check the allotment in my bank account?

Log in to your bank account and check if the IPO amount has been debited

What is the subscription status?

The IPO was 59 times subscribed overall.

What was the IPO price range?

The price range was ₹319 to ₹335 per share.

How many applications were received?

The IPO received 1,55,371 applications.

What was the total fund raised?

The IPO raised ₹160.47 crore.