The Rajputana Biodiesel IPO allotment status has been finalized, bringing excitement to investors eagerly awaiting updates. The IPO, which closed for subscription on November 28, Thursday, saw an overwhelming response, with the issue being subscribed a staggering 718.81 times overall. Here’s a detailed breakdown of the Rajputana Biodiesel IPO allotment process, subscription details, and how you can check your allotment status.

Rajputana Biodiesel IPO Subscription Details

The subscription period for the Rajputana Biodiesel IPO ended on November 28, 2024. The IPO received massive interest across investor categories:

- Total Shares Offered: 12,44,000

- Total Shares Bid: 89,41,99,000

Category-Wise Subscription Data

Non-Institutional Investors (NIIs):

- Shares Offered: 2,70,000

- Shares Bid: 36,34,10,000

- Subscription: 1,345.96 times

Retail Investors:

- Shares Offered: 6,29,000

- Shares Bid: 46,95,92,000

- Subscription: 743.24 times

Qualified Institutional Buyers (QIBs):

- Shares Offered: 3,45,000

- Shares Bid: 6,11,97,000

- Subscription: 177.38 times

Rajputana Biodiesel IPO Details

- Price Band: ₹123 to ₹130 per share

- Lot Size: Minimum 1,000 shares (₹1,30,000 investment)

- Issue Type: Entirely fresh issue of 19 lakh shares

- Funds Raised: ₹24.7 crore

- Listing Date: December 3, 2024

- Platform: NSE SME Emerge

How to Check Rajputana Biodiesel IPO Allotment Status

Investors can check their allotment status through the following methods:

| Maashitla | Allotment Status |

| NSE India | Allotment Status |

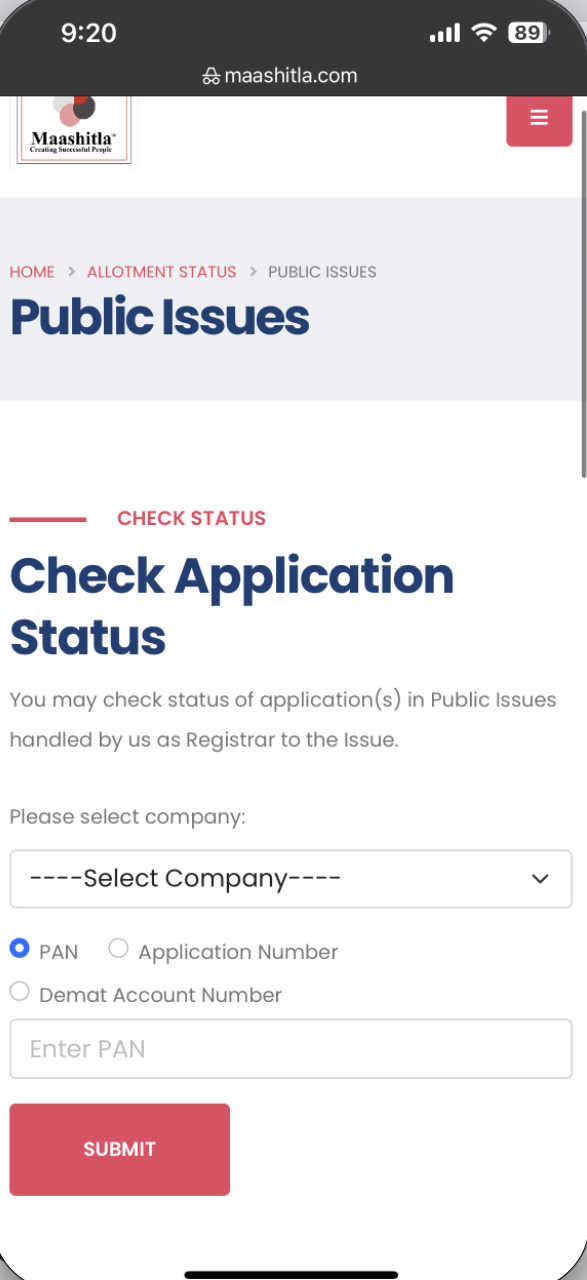

Step I: How to Check Rajputana Biodiesel IPO Allotment Status on Maashitla?

- Visit the Maashitla IPO allotment page at Maashitla.com.

- Select ‘Rajputana Biodiesel’ from the drop-down menu.

- Choose an option: PAN Number, Application Number, or DP ID.

- Enter the required details.

- Click on ‘Search’ to view your allotment status.

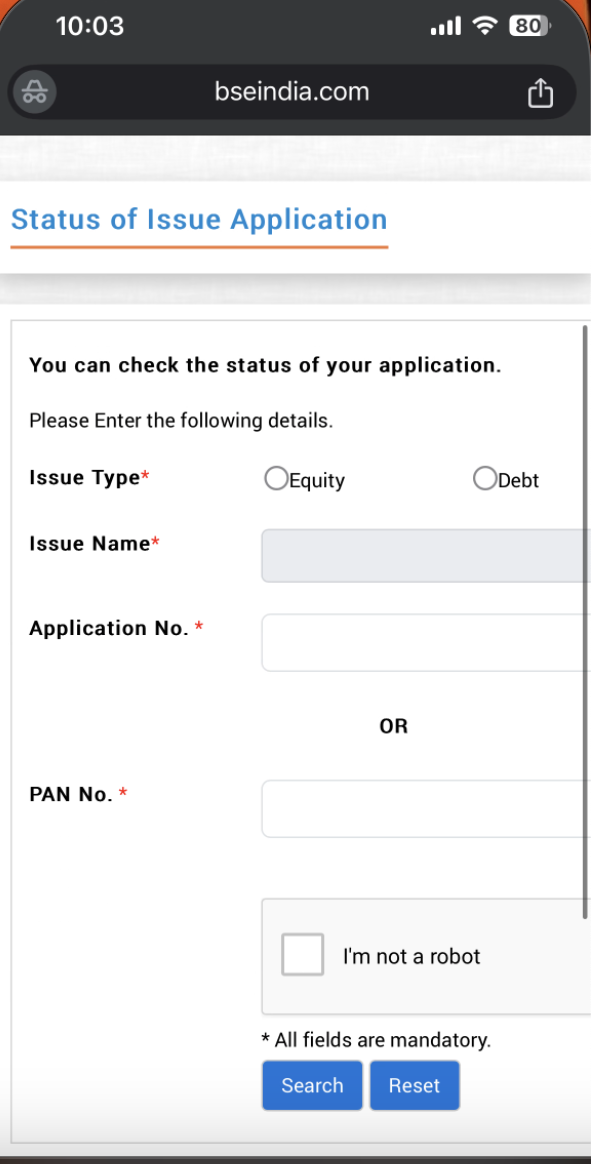

Step II: How to Check Rajputana Biodiesel IPO Allotment Status on NSE?

- Go to the NSE IPO allotment page at NSEIndia.com.

- Select ‘Rajputana Biodiesel’ from the IPO list.

- Enter your PAN Number, Application Number, or DP ID.

- Click on ‘Search’ to check your status.

Step III: In Your Demat Account

- Log in to your Demat/Trading Account or contact your broker.

- Check whether the shares are credited to your account.

Step IV: In Your Bank Account

- Log in to the bank account used to apply for the IPO.

- Check the Balance Tab:

- If allotted, the amount will be debited, and shares will be credited.

- If not allotted, the amount will be refunded.

Important Dates to Remember

- Allotment Finalization: November 29, 2024

- Refund Initiation: December 2, 2024

- Shares Credited to Demat Account: December 2, 2024

- Listing Date: December 3, 2024

Subscription Status Recap (Day 3)

The IPO recorded the following subscriptions on its final day:

- Qualified Institutions: 177.38 times

- Non-Institutional Buyers: 1,345.83 times

- Retail Investors: 743.24 times

Conclusion

Investors who participated in the Rajputana Biodiesel IPO can now check their allotment status through the steps mentioned above. For those not allotted shares, refunds will be processed promptly, while successful applicants will see their shares credited by December 2, 2024. Stay tuned for the IPO listing on December 3, 2024, on the NSE SME platform, Emerge.

Rajputana Biodiesel IPO Allotment Status FAQs

When was the Rajputana Biodiesel IPO allotment status finalized?

The allotment status was finalized on November 29, 2024.

What is the listing date for Rajputana Biodiesel IPO?

The IPO shares will list on December 3, 2024, on the NSE SME Emerge platform.

When will shares be credited to the demat account?

Shares will be credited to the demat accounts of successful investors on December 2, 2024.

What happens if I don’t get the IPO allotment?

If you do not get the allotment, the amount will be refunded to your bank account starting December 2, 2024.

How much was raised through the Rajputana Biodiesel IPO?

The IPO raised ₹24.7 crore through a fresh issue of 19 lakh shares.

What is the platform for Rajputana Biodiesel IPO listing?

The shares will be listed on the NSE SME Emerge platform.