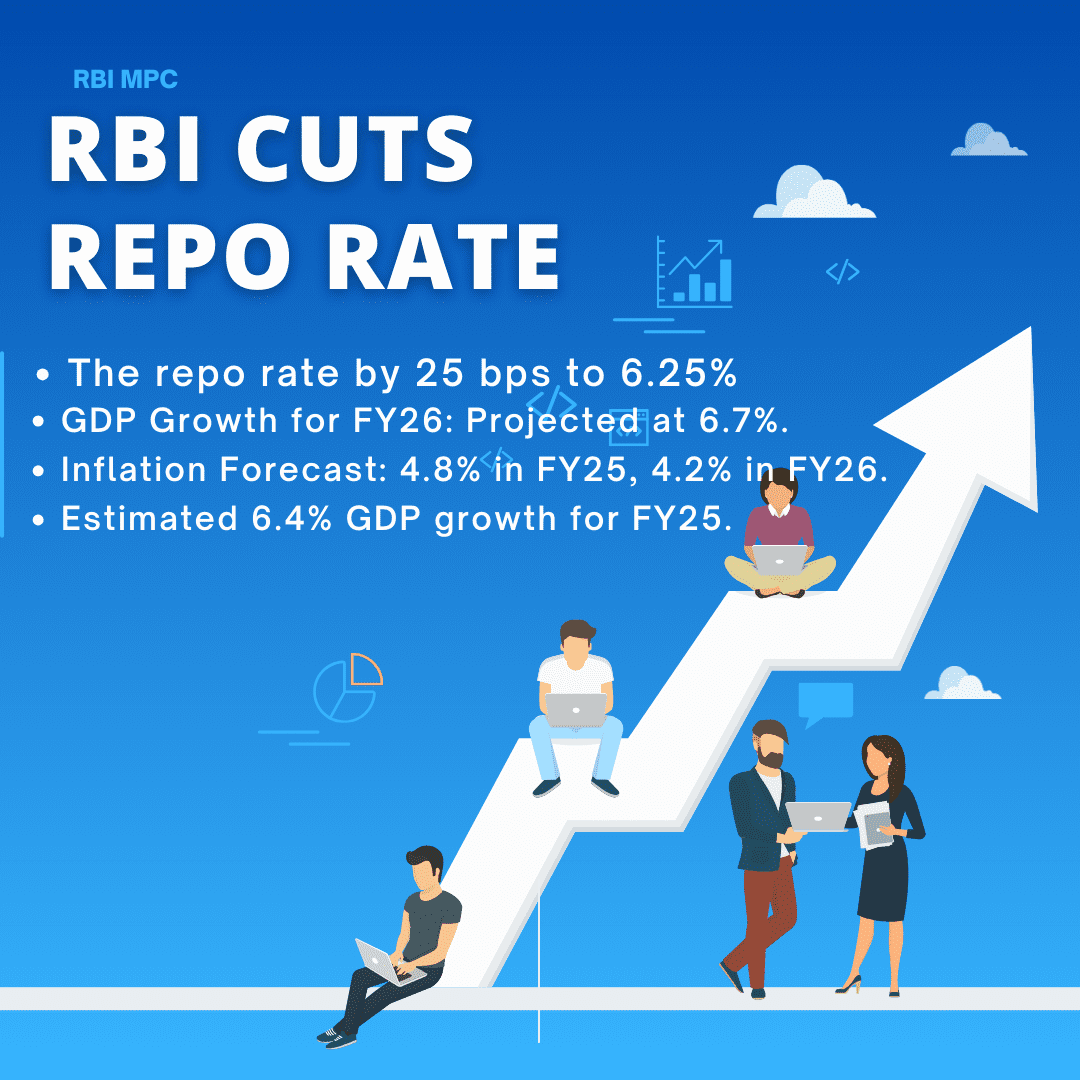

In a significant move, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) unanimously decided to cut the repo rate by 25 basis points to 6.25%, marking the first rate reduction in five years.

The last repo rate cut was in May 2020. RBI Governor Sanjay Malhotra announced the decision, emphasizing that the move aims to stimulate economic growth amid a challenging global environment.

Overview of Contents

Key Highlights

This marks the first monetary policy decision under Governor Sanjay Malhotra, who recently took office. His leadership comes at a crucial time as the central bank navigates economic uncertainties while ensuring financial stability. The repo rate cut, coupled with recent personal income tax reductions, is expected to boost consumption and investment, fostering economic momentum in the coming quarters.

Repo Rate Cut

The repo rate, the rate at which the RBI lends to commercial banks, has been reduced from 6.5% to 6.25%. This reduction is expected to make borrowing cheaper, encouraging spending and investment to boost economic activity.

GDP Growth Projections

- The RBI projects India’s real GDP growth at 6.7% for FY26.

- For FY25, the GDP growth estimate has been revised to 6.4%, 20 basis points lower than the RBI’s December 2023 projection.

- Quarterly GDP growth estimates for FY26 have also been adjusted:

| Quarter | GDP Growth Estimate |

|---|---|

| Q1FY26 | 6.7% (Revised down from 6.9%) |

| Q2FY26 | 7.0% (Revised down from 7.3%) |

| Q3FY26 | 6.5% |

| Q4FY26 | 6.5% |

Inflation Outlook

- The RBI has kept its inflation projection unchanged at 4.8% for FY25 and 4.2% for FY26.

- For FY26, inflation is expected to be 4.6% in Q1 and 4% in Q2.

Global Economic Challenges

Governor Malhotra highlighted that the global economic backdrop remains challenging, with growth below historical averages. He noted that while high-frequency indicators suggest resilience, risks such as potential global trade wars and AI-induced disruptions could impact growth.

Fiscal Deficit Target

The government aims to maintain the fiscal deficit at 4.8% of GDP for FY25, with plans to reduce it below 4.5% by FY26.

Economic Survey 2025 Insights

The Economic Survey 2025 estimates India’s real GDP growth at 6.4% for FY25, slightly lower than the RBI’s projection. It also forecasts growth in the range of 6.3-6.8% for FY26, citing moderate prospects due to headwinds like global trade tensions and technological disruptions.

RBI’s Neutral Stance

The MPC has maintained its “neutral” monetary policy stance, providing flexibility to respond to evolving macroeconomic conditions. Governor Malhotra emphasized that the inflation-targeting framework has been effective in maintaining price stability, with Consumer Price Index (CPI) inflation largely aligned with the target, barring occasional breaches of the upper tolerance band.

Context and Implications

The rate cut comes amid global uncertainties, including rising trade tensions and a stronger US dollar. Domestically, the move follows the government’s recent reduction in personal income tax to boost consumption. The RBI’s decision aims to support economic growth while ensuring inflation remains within the target range.

RBI Repo Rate Cut – Latest GDP Growth Estimates

| Period | GDP Growth Estimate |

|---|---|

| FY26 | 6.7% |

| Q1FY26 | 6.7% |

| Q2FY26 | 7.0% |

| Q3FY26 | 6.5% |

| Q4FY26 | 6.5% |

RBI’s Repo Rate Cut Brings EMI Relief for Homebuyers

In a much-awaited move, the Reserve Bank of India has reduced the repo rate by 25 basis points to 6.25%, offering relief to home loan borrowers struggling with rising EMIs. This marks the first rate cut in nearly five years and is expected to prompt banks to lower lending rates, making home loans more affordable.

With floating interest rate borrowers set to benefit the most, industry experts predict a noticeable decline in monthly loan payments. However, the impact will depend on how banks pass on the benefits to customers. Homebuyers, who have faced increasing financial pressure since rate hikes began in 2022, welcome this decision as a much-needed breather in their homeownership journey.

RBI’s Rate Cut: Boost for Borrowing, Auto Sector

Conclusion:

The RBI’s rate cut and growth projections reflect a cautious yet proactive approach to navigating domestic and global economic challenges. By lowering borrowing costs and maintaining a neutral stance, the central bank seeks to balance growth and inflation, ensuring macroeconomic stability in the coming years.