The Sacheerome IPO Allotment Status is available now. The IPO subscription had started on June 9, 2025, and ended on June 11, 2025, Wednesday. The allotment was released on June 12, 2025, Thursday, after the basis of allotment was finalized.

The investors who applied for the IPO will be able to check the Sacheerome IPO Allotment Status on the MUFG Intime India Private Ltd website or NSE website. The IPO GMP went around ₹40 level after the subscription ended.

Sacheerome IPO received an overwhelming response from investors and was subscribed 312.94 times overall by the end of Day 3 on June 11, 2025, at 6:20 PM. The retail investor portion saw a strong demand with a subscription of 180.28 times, while the Qualified Institutional Buyers (QIBs) subscribed 173.15 times.

The most notable response came from the Non-Institutional Investors (NIIs or HNIs) category, which was oversubscribed by a massive 808.56 times. The IPO had a total of 40,18,800 shares offered across all categories and received bids for over 125.76 crore shares, involving a total application amount of approximately ₹12,828 crore from 3,36,159 applications.

The anchor investor portion was fully subscribed with 17,19,600 shares, and the market maker portion was also fully covered with 3,02,400 shares. This enthusiastic subscription indicates robust investor interest and strong market confidence in Sacheerome’s business potential.

Overview of Contents

Sacheerome IPO Dates

| Event | Date |

|---|---|

| IPO Open Date | Monday, 09 June 2025 |

| IPO Close Date | Wednesday, 11 June 2025 |

| Allotment | Thursday, 12 June 2025 |

| Initiation of Refunds | Friday, 13 June 2025 |

| Credit of Shares to Demat | Friday, 13 June 2025 |

| Listing Date | Monday, 16 June 2025 |

| Cut-off time for UPI mandate confirmation | 5:00 PM on Wednesday, 11 June 2025 |

How to Check Sacheerome IPO Allotment Status?

Investors who applied for Sacheerome IPO can check their allotment status through 4 different methods: MUFGIntime,NSE website, Demat Account, and Bank Account. Follow the steps below to check your IPO allotment status.

| MUFG Intime: | MUFG Intime IPO Allotment Page |

| BSE: | BSE IPO Allotment Page |

| NSE: | NSE IPO Allotment Page |

| EMI | IPO Allotment Page |

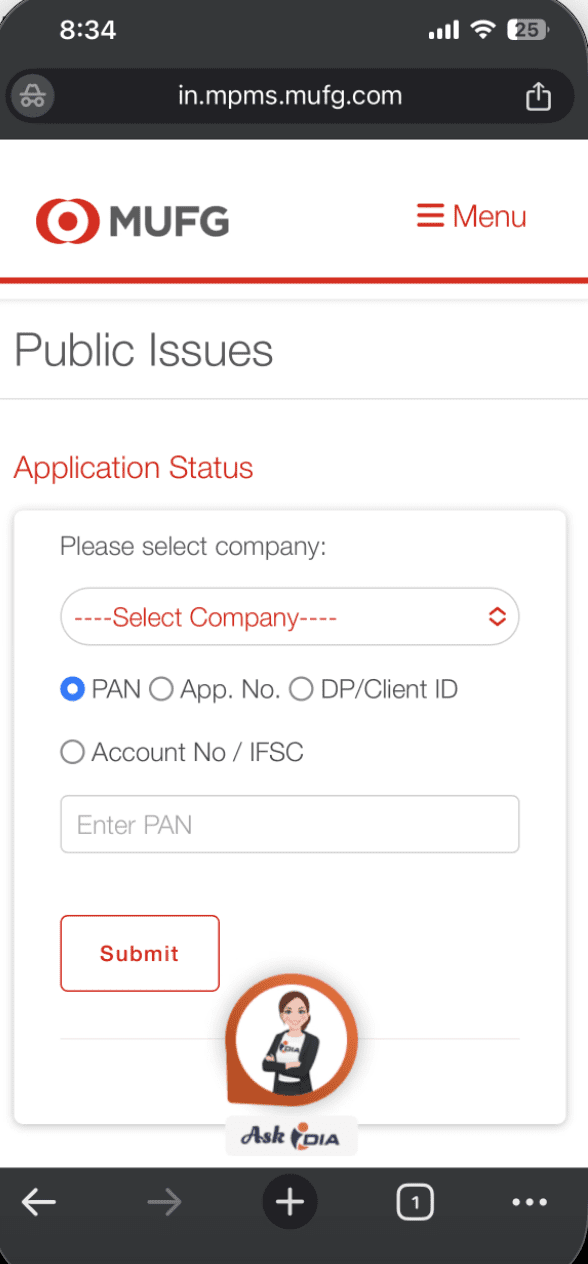

Step 1: How to Check Sacheerome IPO Allotment Status on Mufgintime?

- Visit the Mufgintime IPO allotment page.

- Select ‘Sacheerome IPO’ from the drop-down menu.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and the captcha code.

- Click ‘Search’ to view your allotment status

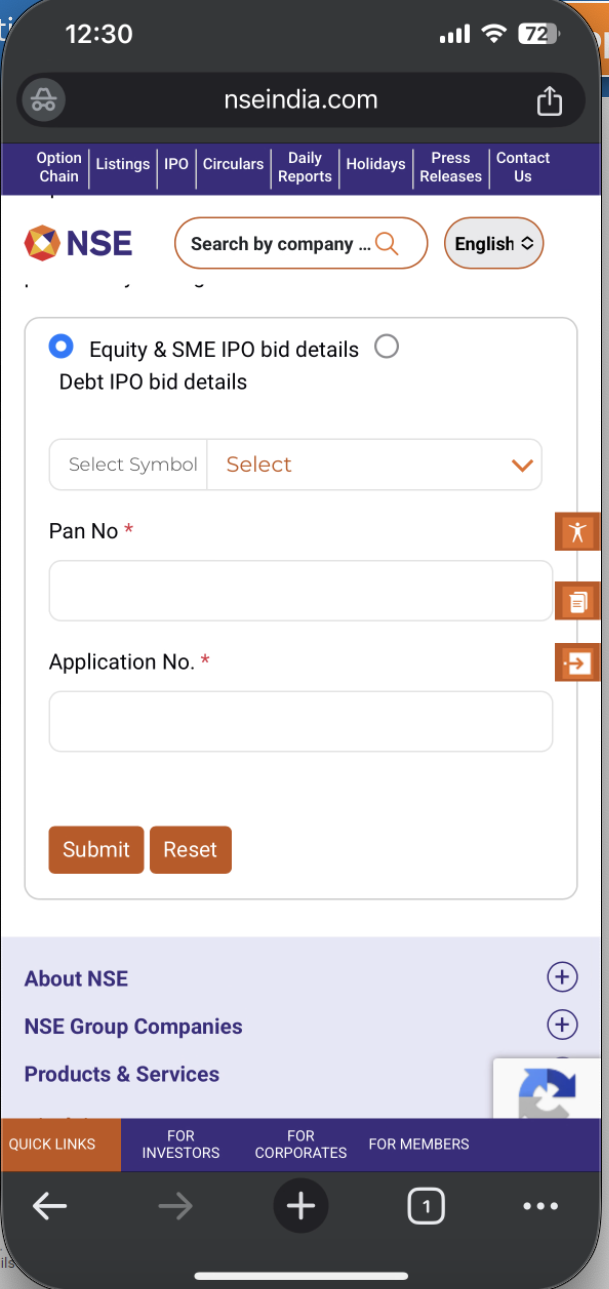

Step 2: How to Check Sacheerome IPO Allotment Status on NSE?

- Visit the NSE IPO allotment page.

- Select ‘Sacheerome IPO’ from the list of IPOs.

- Choose your search criteria: Application Number, PAN, or DP ID.

- Enter the required details and captcha code.

- Click ‘Search’ to display your allotment status.

Step 3: How to Check Sacheerome IPO Allotment in Your Demat Account?

- Log in to your Demat or trading account.

- Navigate to the holdings or portfolio section.

- Check if ‘Sacheerome IPO’ shares are credited to your account.

- If allotted, the shares will be visible in your holdings.

Step 4: How to Check Sacheerome IPO Allotment in Your Bank Account?

- Log in to the bank account used for the IPO application.

- Review your account statement or transaction history.

- If shares are allotted, the IPO amount will be debited from your account.

- If not allotted, the blocked amount will be released, and you may receive an SMS or email notification regarding the refund.

About Company

Financially, Sacheerome Limited has shown consistent growth. As of September 30, 2024, the company reported total assets of ₹70.44 crore and revenue of ₹50.78 crore. For FY 2023-24, its revenue stood at ₹86.4 crore, with a profit after tax of ₹5.99 crore. The company’s net worth has improved to ₹53 crore from ₹45.95 crore in FY23. Sacheerome also maintains healthy reserves and surplus of ₹36.66 crore, and its total borrowings are low at ₹1.69 crore.

Incorporated in June 1992, Sacheerome Limited is a creative company that focuses on designing and manufacturing fragrances and flavors. The company offers a wide range of products, from cosmetic fragrances and industrial scents to perfumes, food additives, and flavoring essences. It serves as a key supplier to major FMCG players, both in India and abroad, including markets in the Middle East (UAE) and Africa.

Sacheerome IPO FAQs

When is the Sacheerome IPO Allotment Date?

The Neptune Petrochemicals IPO allotment is expected to be available on June 12, 2025 (Thursday).

What is the Sacheerome IPO Refund Date?

👉 Refunds for non-allotted applications will be initiated on June 13, 2025 (Friday).

How can I check the Sacheerome IPO Allotment Status?

👉 You can check the allotment status using:

- Your PAN number

- Your application number

- The amount deducted in your bank account.