The Senores Pharmaceuticals IPO allotment status is available as the basis of allotment has been finalized. Investors who applied for the IPO can check their allotment status on LinkInTime.com or the BSE and NSE websites, or through the provided links. The IPO subscription ended on 24th December, Tuesday. The ₹582.11 crore public offering, priced between ₹372 and ₹391 per share with a lot size of 38 shares, received overwhelming demand, with bids totaling 79.96 crore shares against the 85.35 lakh shares offered, resulting in an oversubscription of 93.69 times.

The highest demand came from Non-Institutional Investors (NIIs), who subscribed 96.30 times their reserved quota, followed by Qualified Institutional Buyers (QIBs) at 94.66 times and Retail Individual Investors (RIIs) at 90.46 times. The shares of Senores Pharmaceuticals are commanding a Grey Market Premium (GMP) of nearly 60%, with a reported GMP of ₹230, suggesting a potential listing gain of 58.82%.

Overview of Contents

Senores Pharmaceuticals IPO Important Dates

| Event | Date | Details/Notes |

|---|---|---|

| IPO Open Date | Friday, December 20, 2024 | Investors can start applying for the IPO from this date. |

| IPO Close Date | Tuesday, December 24, 2024 | Last date to submit IPO applications. Ensure UPI mandate is confirmed before the cut-off time. |

| Cut-off Time for UPI Mandate | 5 PM on December 24, 2024 | Retail investors using UPI must approve mandates before this time. |

| Basis of Allotment Finalization | Thursday, December 26, 2024 | The allotment status will be declared on this date. |

| Initiation of Refunds | Friday, December 27, 2024 | Refunds will be initiated for non-allotted applications. |

| Credit of Shares to Demat | Friday, December 27, 2024 | Shares will be credited to successful applicants’ Demat accounts. |

| Listing Date | Monday, December 30, 2024 | Shares will start trading on BSE and NSE. |

Check Senores Pharmaceuticals IPO Allotment Status Links

| Linkintime: | Linkintime IPO Allotment Page |

| BSE: | BSE IPO Allotment Page |

| Equity Market Insights | IPO Allotment Status Page |

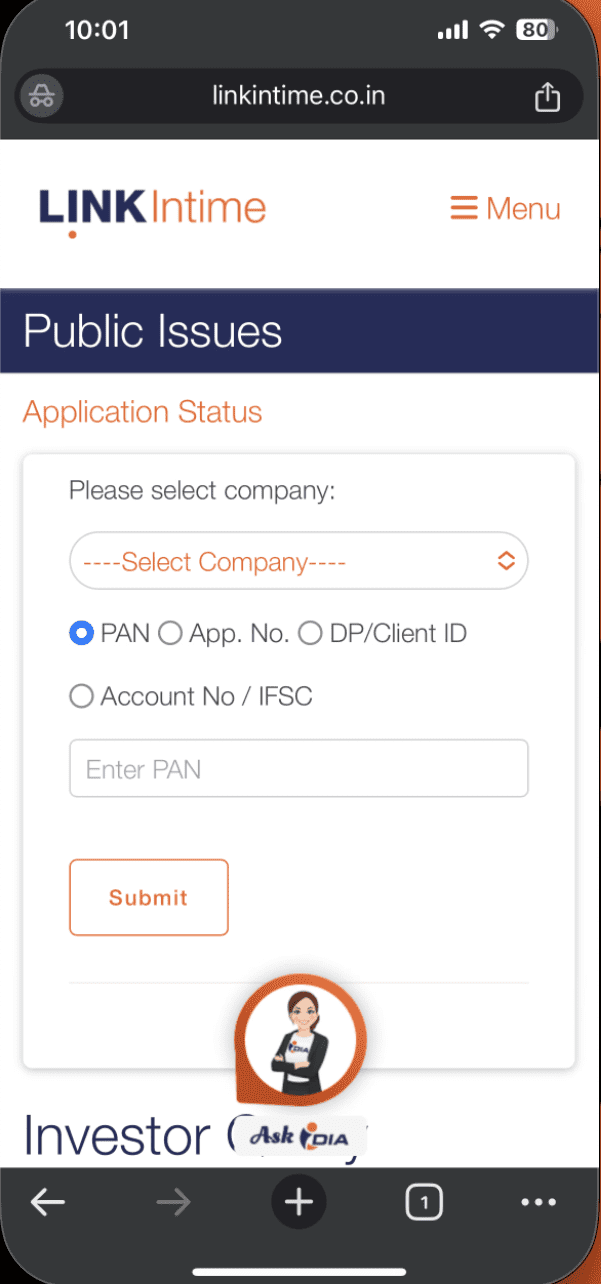

Step 1: How to Check Senores Pharmaceuticals IPO Allotment Status on Linkintime India

- Visit the Senores Pharmaceuticals IPO allotment page on Linkintime India website.

- From the drop-down menu, select the IPO Name “Senores Pharmaceuticals IPO”.

- Choose one of the following options to search: PAN Number, Application Number, or DP ID.

- Depending on your selection, enter your PAN Number, Application Number, or Demat Account Number.

- Click on the ‘Search’ button to view your allotment status.

- Your allotment status will be displayed on the screen (mobile/desktop).

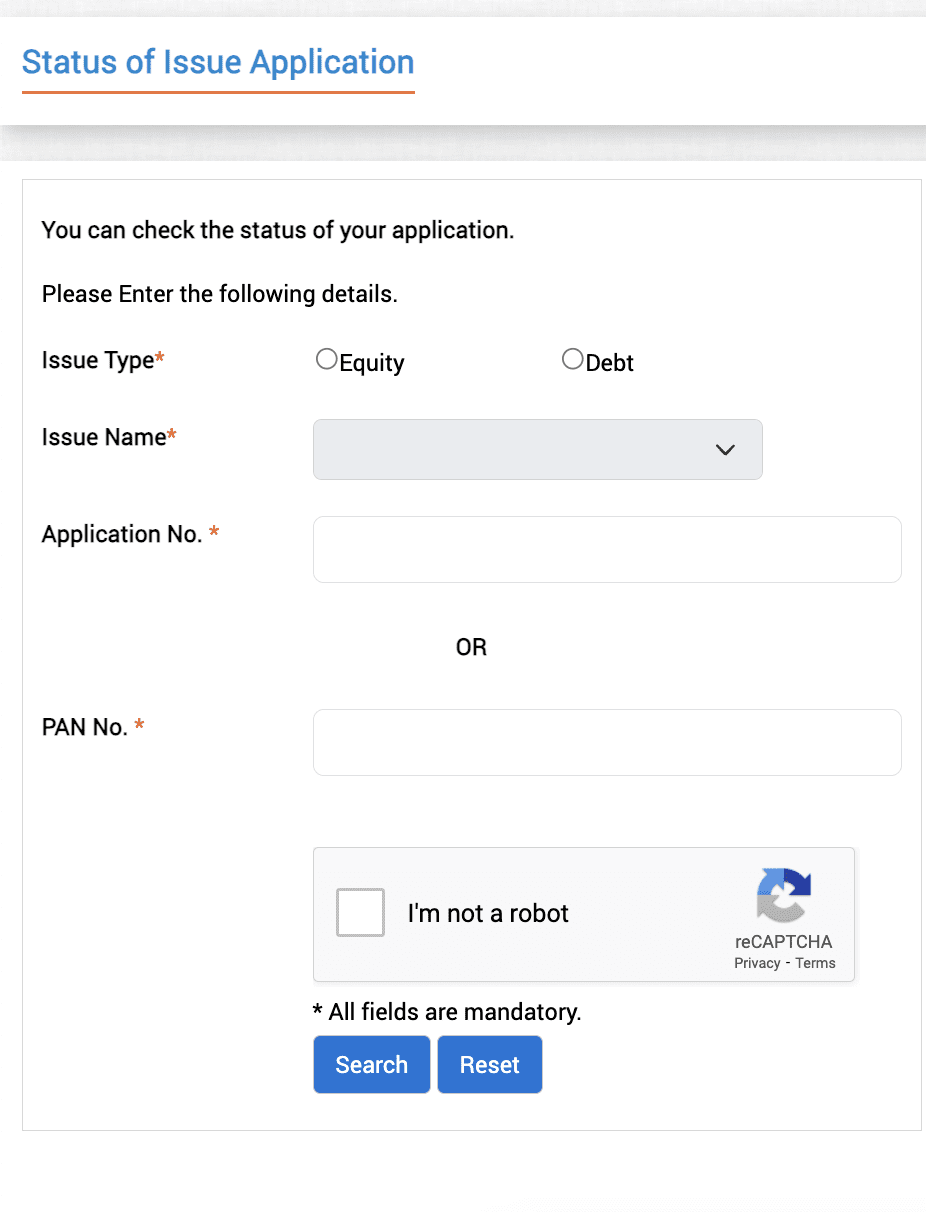

Step 2: How to Check Senores Pharmaceuticals IPO Allotment Status on BSE

- Visit the BSE IPO allotment page at BSEIndia.com.

- Select Senores Pharmaceuticals IPO from the IPO Name drop-down menu.

- Choose from the available options: PAN Number, Application Number, or DP ID.

- Enter your PAN Number, Application Number, or Demat Account Number based on your selection.

- Click the ‘Search’ button.

- Your allotment status will appear on the screen (mobile/desktop).

Step 3: How to Check Senores Pharmaceuticals IPO Allotment Status in Your Demat Account

- Log in to your Demat Account or Trading Account with your broker.

- Verify if the allotted shares have been credited to your Demat account.

- If you have been allotted shares, you will see the Senores Pharmaceuticals IPO shares in your account.

Step 4: Check Senores Pharmaceuticals IPO Allotment Status in Your Bank Account

- Log in to the Bank Account from which you applied for the Senores Pharmaceuticals IPO.

- Navigate to the Balance Tab to check for any debit.

- If you received the allotment, the IPO amount will be debited from your account.

- If you did not receive the allotment, the amount will be released back to your account.

- If allotted shares, you will receive an SMS notification:

“Dear Customer, Bank Name Account 00001 is debited with INR 00000.00 on Date. Info: IPO Name. The Available Balance is INR 000000.”

These steps will guide you through checking your allotment status for the Senores Pharmaceuticals IPO through multiple platforms.

About Company

Incorporated in December 2017, Senores Pharmaceuticals Limited develops and manufactures a wide range of pharmaceutical products for regulated markets in the US, Canada, and the UK, along with emerging markets. Their product portfolio includes treatments for various therapeutic areas such as antibiotics, anti-fungal, and critical care injectables.

With 55 products launched by September 2024, the company operates three dedicated R&D facilities in India and the US. Senores Pharmaceuticals’ manufacturing unit is located in Ahmedabad, Gujarat, and they hold long-term marketing agreements with pharmaceutical companies across global markets. The company is driven by strong R&D capabilities and a diverse product range.

Senores Pharmaceuticals IPO Allotment Status FAQs

How can I check Senores Pharmaceuticals IPO allotment status?

You can check your Senores Pharmaceuticals IPO allotment status on the LinkIntime website, or through the official BSE and NSE IPO allotment pages by entering your PAN, application number, or Demat account number.

What was the subscription rate for Senores Pharmaceuticals IPO?

The Senores Pharmaceuticals IPO received an oversubscription of 93.69 times, with the highest demand from Non-Institutional Investors (NIIs) followed by Qualified Institutional Buyers (QIBs) and Retail Individual Investors (RIIs).

When does the Senores Pharmaceuticals IPO allotment status get finalized?

The Senores Pharmaceuticals IPO allotment status is available once the basis of allotment is finalized, which typically happens after the subscription period ends.

What is the GMP (Grey Market Premium) for Senores Pharmaceuticals IPO?

The Senores Pharmaceuticals IPO is commanding a Grey Market Premium (GMP) of nearly 60%, with a quoted GMP of Rs 230, suggesting a listing gain of 58.82%.

Where can I check the allotment status for Senores Pharmaceuticals IPO?

You can check the IPO allotment status on LinkIntime, BSE, or NSE websites by entering your PAN, application number, or Demat account number.