Market Overview of 4th Feb 2025, The Indian benchmark indices surged on Tuesday, recording their best day since early January, as investor sentiment improved following the U.S. decision to delay tariffs on Canada and Mexico. The rally was further supported by strong buying in auto and financial stocks, positive trends in Asian markets, and expectations of a rate cut by the Reserve Bank of India (RBI).

The NIFTY 50 rose 1.62% to close at 23,739.25, while the SENSEX gained 1,397.07 points (1.81%), ending at 78,583.81. The NIFTY Bank index surged 1.93% to 50,157.95, and the NIFTY IT index climbed 1.29% to 42,860.20. The BSE Smallcap index also saw an increase of 1.20%, settling at 49,801.07.

Key Reasons Behind Today’s Rally

Several key factors are driving this upward movement, and we’ve outlined the main reasons below for this market surge.

U.S. Tariff Suspension on Canada and Mexico

U.S. President Donald Trump’s decision to delay tariffs on Canada and Mexico for 30 days eased global trade tensions. The move was conditional on Canada’s efforts against fentanyl and Mexico’s border security measures, but it provided relief to global markets.

Decline in U.S. Dollar Index

The U.S. Dollar Index fell 0.50% to 108.57, leading to a rise in emerging markets, including India. The euro weakened 0.67% to $1.0293, reinforcing expectations that the Federal Reserve may maintain its current interest rates in March.

Positive Asian Market Trends

Global sentiment improved, with key Asian indices posting strong gains. Japan’s Nikkei 225 climbed 1.6% to 39,140.41, while Hong Kong’s Hang Seng Index rose 2.5%. Additionally, U.S. equity futures traded higher, with S&P 500 futures gaining 0.4%.

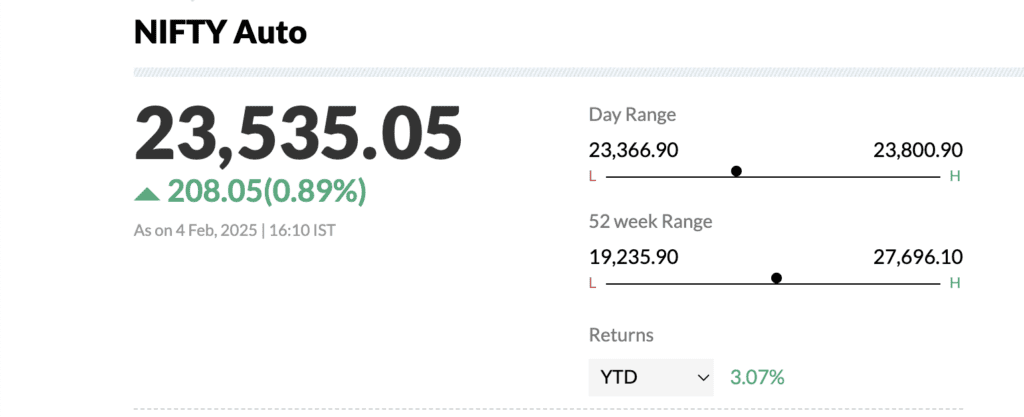

Strong Auto Sector Performance

The NIFTY Auto index surged 1.8%, driven by strong January sales data from major manufacturers. Maruti Suzuki India reported record sales of 212,251 units, while Eicher Motors posted a 20% rise in motorcycle sales. Hero MotoCorp also recorded a 2.13% increase in total sales, with exports soaring 141%.

Broad-Based Market Gains

Twelve out of thirteen major domestic sectors closed in the green. Small- and mid-cap stocks rose 1%, signaling strong investor confidence. Heavyweights like Infosys, Tata Motors, Larsen & Toubro, and Tata Steel led the rally, while defensive stocks such as Power Grid, Hindustan Unilever, and Nestle lagged.

RBI MPC Meeting and Rate Cut Hopes

The RBI’s Monetary Policy Committee (MPC) meeting, scheduled for February 5-7, has heightened investor expectations of a 25 basis point rate cut. Economists predict a repo rate reduction to 6.25%, along with possible liquidity-boosting measures such as a Cash Reserve Ratio (CRR) cut or bond purchases.

Index Performance

| Index | Price | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 23,739.25 | +378.20 | +1.62% |

| SENSEX | 78,583.81 | +1,397.07 | +1.81% |

| NIFTY BANK | 50,157.95 | +947.40 | +1.93% |

| NIFTY IT | 42,860.20 | +545.95 | +1.29% |

| BSE Smallcap | 49,801.07 | +588.77 | +1.20% |

Top Gainers

| Company | Current Price | % Gain |

|---|---|---|

| Shriram Finance | ₹576.75 | +5.60% |

| Larsen | ₹3,439.15 | +4.56% |

| Bharat Elec | ₹284.50 | +3.78% |

| Adani Ports | ₹1,125.10 | +3.71% |

| IndusInd Bank | ₹1,047.15 | +3.40% |

Top Losers

| Company | Current Price | % Loss |

|---|---|---|

| Trent | ₹5,750.30 | -6.27% |

| Britannia | ₹5,028.35 | -1.51% |

| Hero Motocorp | ₹4,237.10 | -1.16% |

| Nestle | ₹2,299.45 | -0.76% |

| Eicher Motors | ₹5,450.10 | -0.64% |

Institutional Investors Trading Data – February 4, 2025

| Category | Date | Buy Value (₹ Crores) | Sell Value (₹ Crores) | Net Value (₹ Crores) |

|---|---|---|---|---|

| DII ** | 04-Feb-2025 | 15,002.64 | 15,433.34 | -430.70 |

| FII/FPI * | 04-Feb-2025 | 18,105.75 | 17,296.52 | 809.23 |

Key Market Highlights

- Sensex & Nifty Turn Positive for 2025, each rising nearly 2%.

- Market Cap of 28 BSE-listed Companies Increases by Over ₹5 Lakh Crore.

- Nifty Infra Index Gains 2% as capex-driven stocks recover Monday’s losses.

- Defence Stocks Surge following government orders, with companies like Bharat Electronics and Hindustan Aeronautics seeing strong buying.

- NBFC Stocks Extend Monday’s Gains, with Shriram Finance and Cholamandalam Finance each rising 5%.

- Asian Paints Gains 3% despite mixed Q3 results.

- Kalyan Jewellers Surges 15% as buying returns.

- Capex Stocks Like ABB, Siemens, NCC, and Cummins Gain 5-8%.

Market Outlook

Technical analysts suggest that the markets are poised for further upside, with Nifty 50’s key resistance at 23,840 and support at 23,440. Analysts believe that the current rally could extend, with the next immediate target range being 23,800-24,000.

As per experts’ view, downside attempts were limited, and the 23,190 level held firm. We maintain our bullish outlook with a target range of 23,700–23,840.

Looking ahead, market participants will closely monitor the RBI’s policy decision, global cues, and Q3 earnings reports from major corporations. Sectors such as auto, banking, and capital goods remain in focus, driven by strong demand and policy support.

Conclusion

The Indian stock market recorded an impressive rally, driven by positive global sentiment, easing trade war concerns, strong corporate earnings, and expectations of a rate cut by the RBI. With broad-based sectoral gains and robust foreign and domestic investor participation, the market momentum is likely to sustain in the near term. However, investors should remain cautious about global economic developments and geopolitical risks that could influence market volatility.