The Indian stock markets witnessed a sharp decline on January 27, 2025, with all major indices ending in the red. The NIFTY 50 fell 1.14%, SENSEX dropped 1.08%, and NIFTY IT witnessed the steepest loss of 3.36%. BSE Smallcap also suffered a significant decline of 3.51%. Weak performances in IT and metal sectors contributed to the bearish sentiment, while select banking and FMCG stocks provided some support.

Key Indices Performance

| Index | Current | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 22,829.15 | -263.05 | -1.14% |

| SENSEX | 75,366.17 | -824.29 | -1.08% |

| NIFTY BANK | 48,064.65 | -303.15 | -0.63% |

| NIFTY IT | 42,060.70 | -1,463.40 | -3.36% |

| BSE Smallcap | 48,346.37 | -1,761.14 | -3.51% |

Top Gainers

| Company | Current Price (₹) | % Loss |

|---|---|---|

| HCL Tech | 1,711.95 | -4.51% |

| Tech Mahindra | 1,653.90 | -4.01% |

| Wipro | 307.95 | -3.80% |

| Hindalco | 586.90 | -3.30% |

| Shriram Finance | 511.65 | -3.00% |

Top Losers

| Company | Current Price (₹) | % Loss |

|---|---|---|

| HCL Tech | 1,711.95 | -4.51% |

| Tech Mahindra | 1,653.90 | -4.01% |

| Wipro | 307.95 | -3.80% |

| Hindalco | 586.90 | -3.30% |

| Shriram Finance | 511.65 | -3.00% |

Institutional Investment Activity

| Category | Date | Buy Value (₹ Crores) | Sell Value (₹ Crores) | Net Value (₹ Crores) |

|---|---|---|---|---|

| DII | 27-Jan-2025 | 16,503.43 | 9,861.28 | 6,642.15 |

| FII/FPI | 27-Jan-2025 | 9,488.57 | 14,504.03 | -5,015.46 |

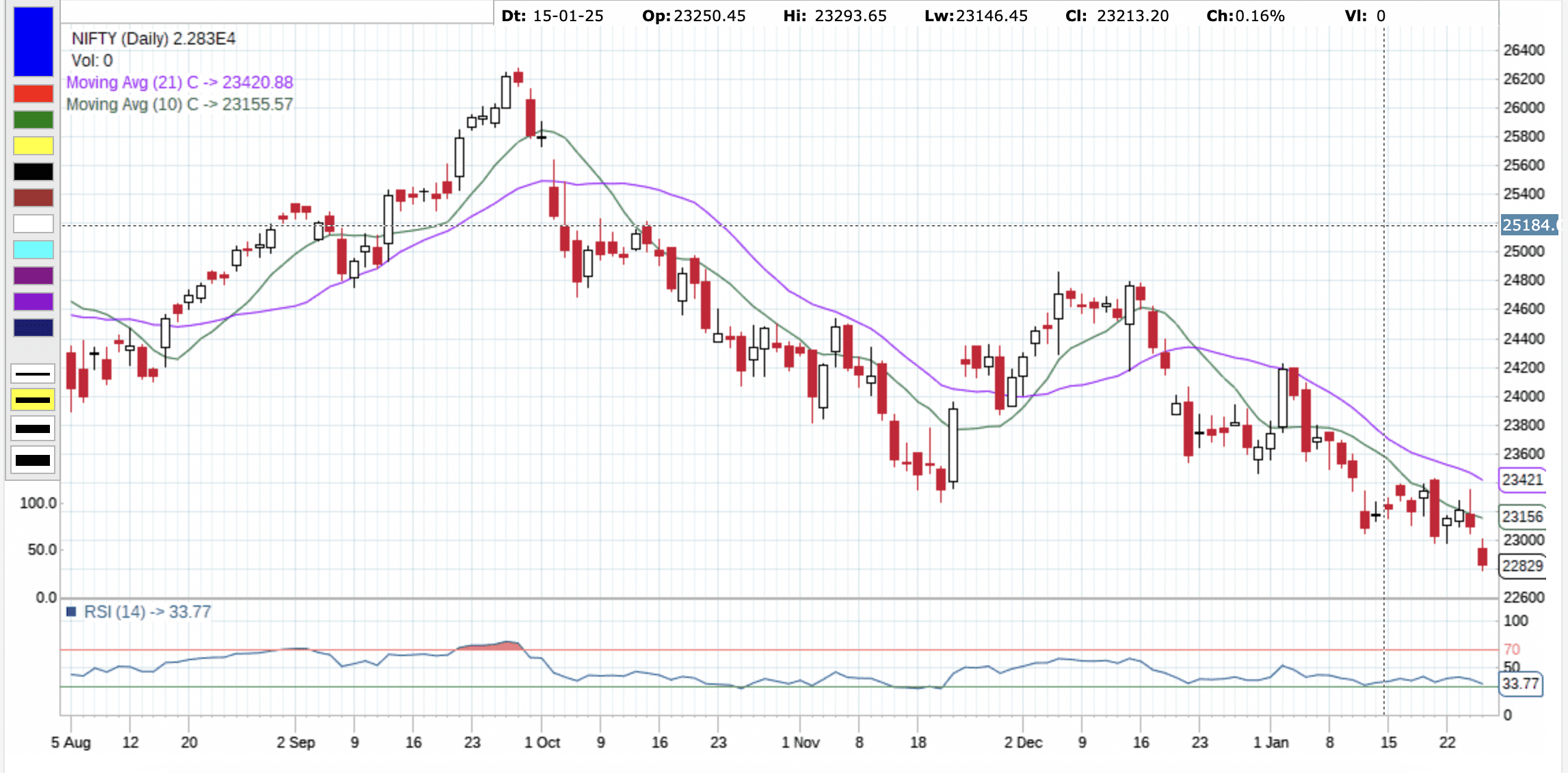

Nifty 50 Technical Analysis

The Nifty 50 broke the psychological level of 23,000, closing at 22,829, down 1.14%. This marks the lowest close since June 6, forming a bearish candlestick pattern. Experts suggest further downside toward 22,670 and 22,500 if it closes below 22,800, while resistance remains at 23,000.

Momentum indicators signal a continuation of the negative trend, with broader indices like Nifty Midcap and Smallcap correcting 2.8% and 3.8%, respectively. Derivative data indicates a short-term range of 22,000–23,000, with strong resistance at 23,000 and support at 22,600.

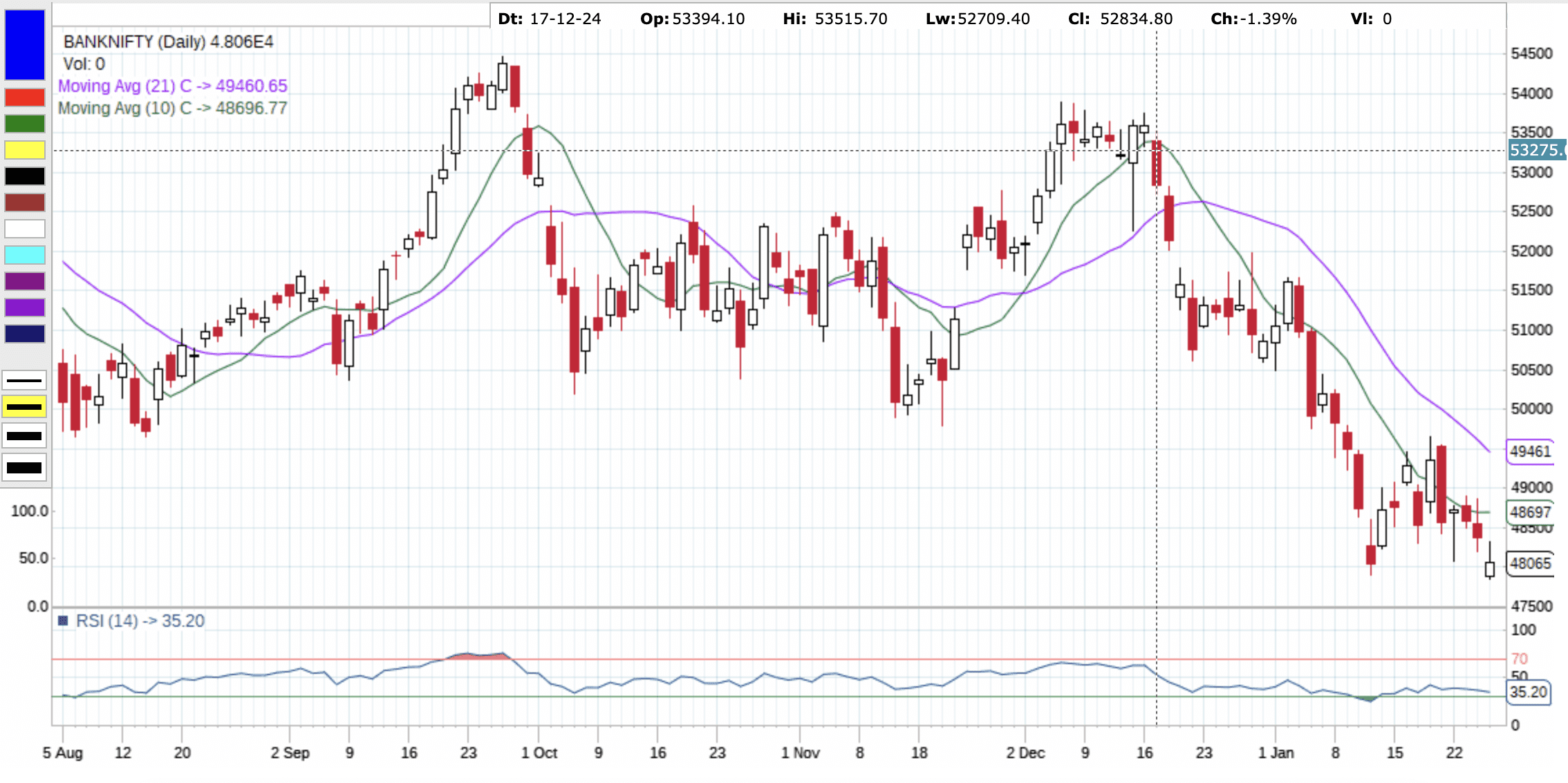

Bank Nifty Technical Analysis

The Bank Nifty fell 303 points to close at 48,065, outperforming the Nifty 50 despite intraday pressure. It formed a bullish candlestick pattern as it sustained above the January 13 low on a closing basis.

Weakness may persist if it trades below 48,250, with support levels at 47,750 and 47,500, while resistance is seen at 48,250 and 48,500. The India VIX rose sharply to 18.13, indicating heightened market volatility ahead of the Budget announcement.

Experts See Long-Term Investment Opportunities Beyond Budget 2025

Despite challenges like capex shortfalls and market volatility, experts predict long-term growth opportunities in key sectors beyond Budget 2025. Sectors such as defense, railways, power, and infrastructure are expected to remain structural growth drivers.

Capital-Led Growth a Priority

The recent growth cycle has been capital-driven, emphasizing capex over consumption. However, concerns remain over the underperformance of capex spending, with only Rs 5.1 lakh crore spent of the Rs 11.1 lakh crore FY25 target. Experts anticipate more clarity post-budget.

Key Sectors: Railways, Roads, and Defence

- Railways: Holds significant potential due to freight and connectivity needs.

- Roads: Challenges in spending persist, but FY26 could see a 15–20% growth.

- Defence: Geopolitical uncertainties and domestic security concerns ensure continued focus.

Infrastructure and Shipping in Focus

Infrastructure, including shipping, remains a government priority. Pure-play infra companies in power, roads, and real estate construction are now more attractively valued, making them appealing to institutional investors.

Power and Green Energy Sectors

Power demand growth offers long-term potential in both renewable and non-renewable energy. Green energy, including EV infrastructure and solar power, benefits from policy support. Transmission remains strong, with significant HVDC orders expected.

Valuations in Infrastructure and Capital Goods

Valuations in infrastructure and capital goods sectors have corrected, making them more attractive. However, some sub-sectors like EMS and bearings face elevated valuations, which could lead to volatility despite structural growth.