The Indian equity market showed mixed performance on January 27, 2025. While benchmark indices NIFTY 50 and SENSEX closed higher, driven by gains in banking and financial stocks, sectors like IT and small-cap witnessed profit booking. NIFTY BANK outperformed with significant gains, while NIFTY IT and BSE SMALLCAP indices ended in the red.

Overview of Contents

Index Performance

| Index | Price | Change | % Change |

|---|---|---|---|

| NIFTY 50 | 22,957.25 | 128.10 | 0.56 |

| SENSEX | 75,901.41 | 535.24 | 0.71 |

| NIFTY BANK | 48,866.85 | 802.20 | 1.67 |

| NIFTY IT | 41,820.65 | -240.05 | -0.57 |

| BSE SMALLCAP | 47,492.48 | -853.89 | -1.77 |

Top Gainers

| Company | Current Price (₹) | % Gain |

|---|---|---|

| Bajaj Finance | 7,606.60 | 4.26 |

| Axis Bank | 983.80 | 3.77 |

| Shriram Finance | 530.10 | 3.61 |

| Bajaj Finserv | 1,768.95 | 3.35 |

| HDFC Bank | 1,670.40 | 2.49 |

Top Losers

| Company | Current Price (₹) | % Loss |

|---|---|---|

| Sun Pharma | 1,705.50 | -4.55 |

| Britannia | 5,060.75 | -2.23 |

| Hindalco | 573.85 | -2.22 |

| Grasim | 2,411.30 | -1.90 |

| Bharat Elec | 258.25 | -1.79 |

Institutional Flows

| Category | Gross Purchase (₹ Cr) | Gross Sale (₹ Cr) | Net (₹ Cr) |

|---|---|---|---|

| DII ** | 19,735.28 | 12,920.95 | 6,814.33 |

| FII/FPI * | 11,165.86 | 16,086.55 | -4,920.69 |

Summary

The market’s positive sentiment was bolstered by strong buying in banking and financial stocks, with NIFTY BANK leading gains at 1.67%. However, weakness in IT and small-cap stocks dragged down broader market performance. Foreign Institutional Investors (FII) were net sellers, pulling ₹4,920.69 crore from the market, while Domestic Institutional Investors (DII) provided support with net buying of ₹6,814.33 crore. The mixed trends highlight selective sectoral performances and caution among global investors.

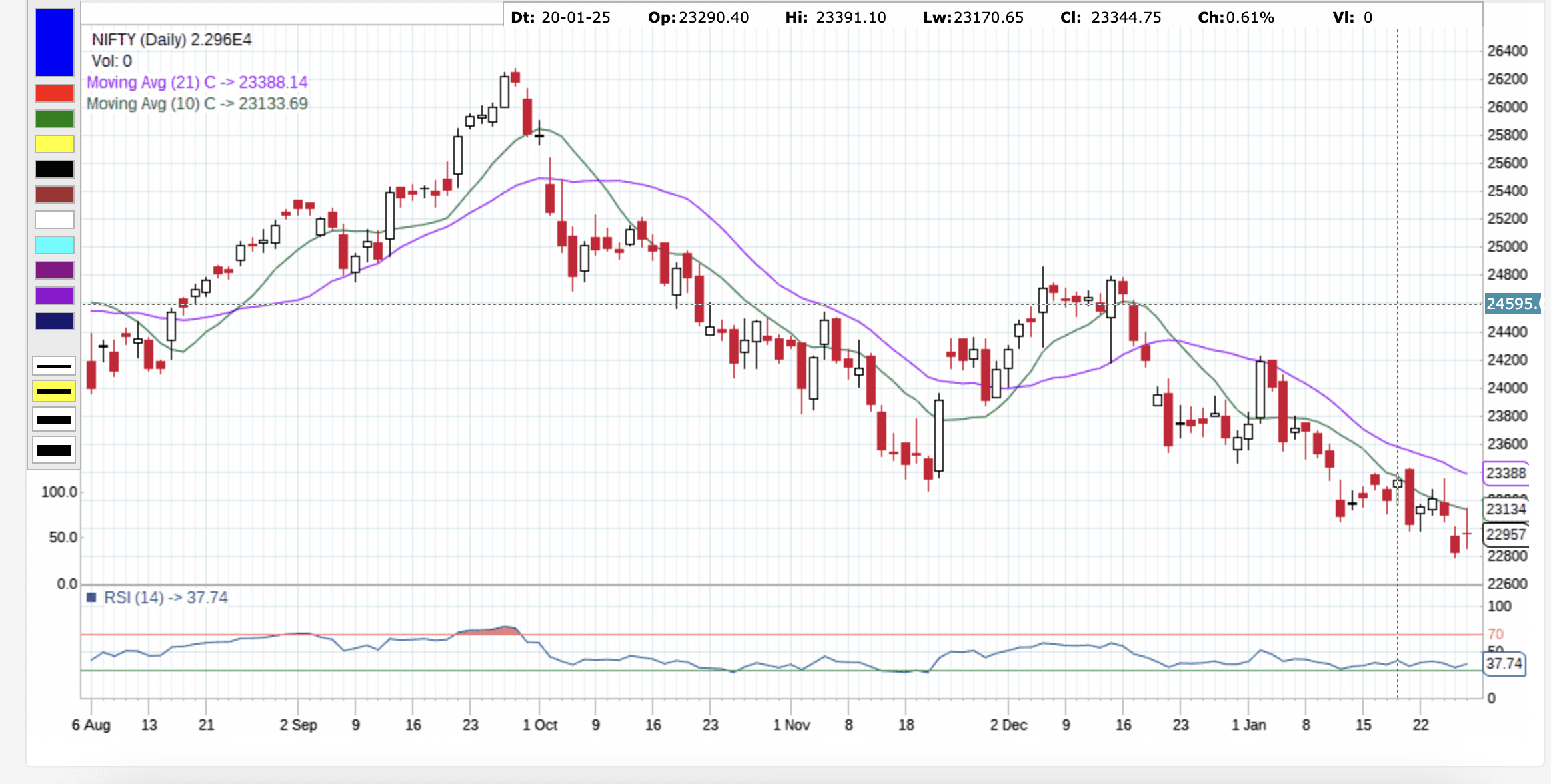

Nifty 50 Technical Analysis

The Nifty 50 rebounded on January 28, 2025, closing at 22,957, up 128 points, after touching an intraday high of 23,138. Despite the recovery, the index remains under bearish control as long as it trades below the critical resistance zone of 23,000–23,050.

A Doji candlestick pattern on the daily chart reflects market indecision ahead of the Budget announcement on February 1. Options data suggests 23,000 as a pivotal level, with the index likely to trade within a broad range of 22,000–24,000 until the Budget.

Key support levels are placed at 22,780–22,670, and any sustained breach below this range could intensify selling pressure. For an upward rally, the index must decisively break and sustain above 23,000, which could open the path toward the 23,500–24,000 range. Elevated volatility, as indicated by the India VIX at 18.20, reinforces the need for a cautious stance.

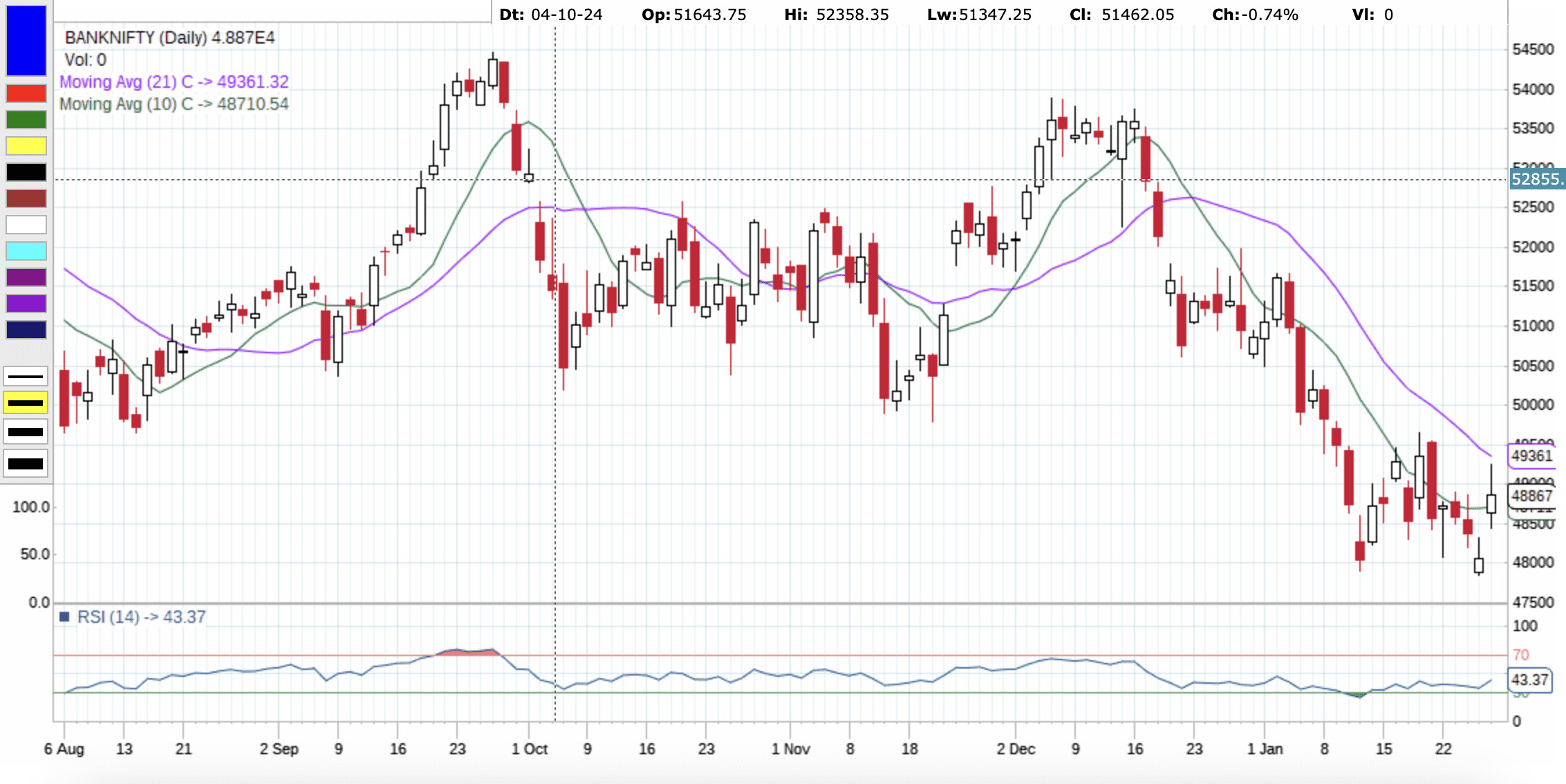

Bank Nifty Technical Analysis

Bank Nifty exhibited strength with a gap-up opening of over 300 points, closing at 48,867, up 802 points (1.67%). The index outperformed the Nifty 50, driven by above-average volumes. It touched an intraday high of 49,247 before paring gains due to selling pressure at higher levels.

A bullish candlestick pattern with a minor lower shadow and a long upper wick on the daily chart indicates resistance near the 49,247 level. For further upside, a decisive move above 48,900 could trigger short covering, pushing the index toward 49,600, the previous swing high. Breaching this level would flip the market structure to bullish.

However, failure to sustain above 48,900 could invite further consolidation or downside pressure. Elevated volatility and a rising VIX call for cautious trading, with key support levels to watch near 48,400.

Jubilant Ingrevia Q3 Results

Jubilant Ingrevia reported an impressive 80% year-on-year (YoY) increase in net profit, which stood at ₹69 crore. Total revenue rose 9% YoY to ₹1,057 crore, while EBITDA grew by 42% YoY to ₹148 crore, with an EBITDA margin of 14%. The company announced an interim dividend of ₹2.5 per share, with the record date set for February 3.

Mahindra Finance Q3 Results

Mahindra Finance’s net profit surged 47% YoY to ₹918 crore, with total income increasing by 16% YoY to ₹4,799 crore.

SBI Card Q3 Results

SBI Card’s net profit declined 30% YoY to ₹383 crore despite a 1% YoY rise in total income to ₹4,767 crore. Interest income grew by 15% YoY to ₹2,082 crore.

Bajaj Auto Q3 Results

Bajaj Auto recorded an 8% YoY increase in net profit to ₹2,196 crore. Revenue from operations also grew 8% YoY to ₹13,169 crore, and the standalone EBITDA margin improved by 10 basis points to 20.2%.

Ixigo Q3 Results

Ixigo’s net profit fell sharply by 49% YoY to ₹15.5 crore, despite a 42% YoY increase in revenue from operations to ₹242 crore.

Bosch Q3 Results

Bosch reported a 12% YoY decline in net profit to ₹458 crore, while revenue from operations rose 6% YoY to ₹4,205 crore.

Colgate Palmolive Q3 Results

Colgate Palmolive’s net profit decreased by 2% YoY to ₹323 crore. Total income increased 5% YoY to ₹1,482 crore, with a 5% growth in net sales to ₹1,452 crore. The EBITDA margin stood at 31%.

Suzlon Energy Q3 Results

Suzlon Energy reported a stellar 91% YoY jump in net profit to ₹387 crore. Revenue surged 91% YoY to ₹2,969 crore, while EBITDA more than doubled to ₹500 crore, with an EBITDA margin of 16.8%.

CG Power Q3 Results

CG Power’s net profit fell 68% YoY to ₹240.5 crore, down from ₹747 crore. However, revenue grew 27% YoY to ₹2,516 crore. EBITDA also increased by 27% YoY to ₹332 crore, with a stable margin of 13.2%. The company announced plans to establish a greenfield transformer manufacturing facility with a capacity of 45,000 MVA, investing ₹712 crore. Its order backlog rose 70% YoY to ₹9,706 crore, with an 82% YoY increase in order inflow to ₹4,390 crore.

JSW Infra Q3 Results

JSW Infra’s net profit climbed 31% YoY to ₹330 crore. Revenue from operations grew 26% YoY to ₹1,182 crore, with total income reaching ₹1,265 crore.

Hindustan Zinc Q3 Results

Hindustan Zinc’s net profit increased by 32% YoY to ₹2,678 crore, with revenue rising 18% YoY to ₹8,315 crore. EBITDA jumped 27% YoY to ₹4,460 crore. However, the company’s shares dropped 4% post-results, currently trading at ₹434.

Cipla Q3 Results

Cipla posted a 49% YoY rise in net profit to ₹1,571 crore, while revenue increased by 7% YoY to ₹7,073 crore. EBITDA grew 16% YoY to ₹1,989 crore, with an EBITDA margin of 28.1%. Cipla’s shares jumped 2%, trading at ₹1,425.

Hyundai Q3 Results

Hyundai reported a 19% YoY decline in net profit to ₹1,161 crore, while revenue decreased by 1.3% YoY to ₹16,648 crore.

TVS Motors Q3 Results

TVS Motors’ net profit rose 4.2% YoY to ₹618 crore. Revenue grew by 10% YoY to ₹9,097 crore, while EBITDA increased 17% YoY to ₹1,081 crore, with an improved EBITDA margin of 11.9%.

Arvind Q3 Results

Arvind reported a 12% YoY increase in net profit to ₹102 crore, with revenue rising 11% YoY to ₹1,882 crore.

Shyam Metalics Q3 Results

Shyam Metalics’ net profit surged 55% YoY to ₹198 crore, with revenue increasing 13% YoY to ₹3,753 crore.