The Toss The Coin IPO allotment status has been finalized today, December 13, 2024. The IPO subscription, which concluded on Thursday, December 12, 2024, saw an overwhelming response from investors, with the subscription rate soaring to an impressive 1,025.76 times. This Rs 9.17-crore SME public offering, priced between ₹172-182 per share with a lot size of 600 shares, witnessed massive demand, reflecting its high investor confidence.

Investors who applied for the IPO can check the allotment status online starting Friday, December 13, 2024. The allotment status will be available on the Link Intime India Private Ltd website or the BSE website. Following the conclusion of the subscription, the grey market premium (GMP) for Toss The Coin shares was around ₹164, signaling strong interest among investors ahead of its listing.

Overview of Contents

How to Check Toss The Coin IPO Allotment Status: A Step-by-Step Guide

If you applied for the Toss The Coin IPO, you can check your allotment status through various methods. Follow these easy steps to know if you’ve received the IPO shares:

| Linkintime: | Linkintime IPO Allotment Page |

| BSE: | BSE IPO Allotment Page |

| Equity Market Insights | IPO Allotment Status Page |

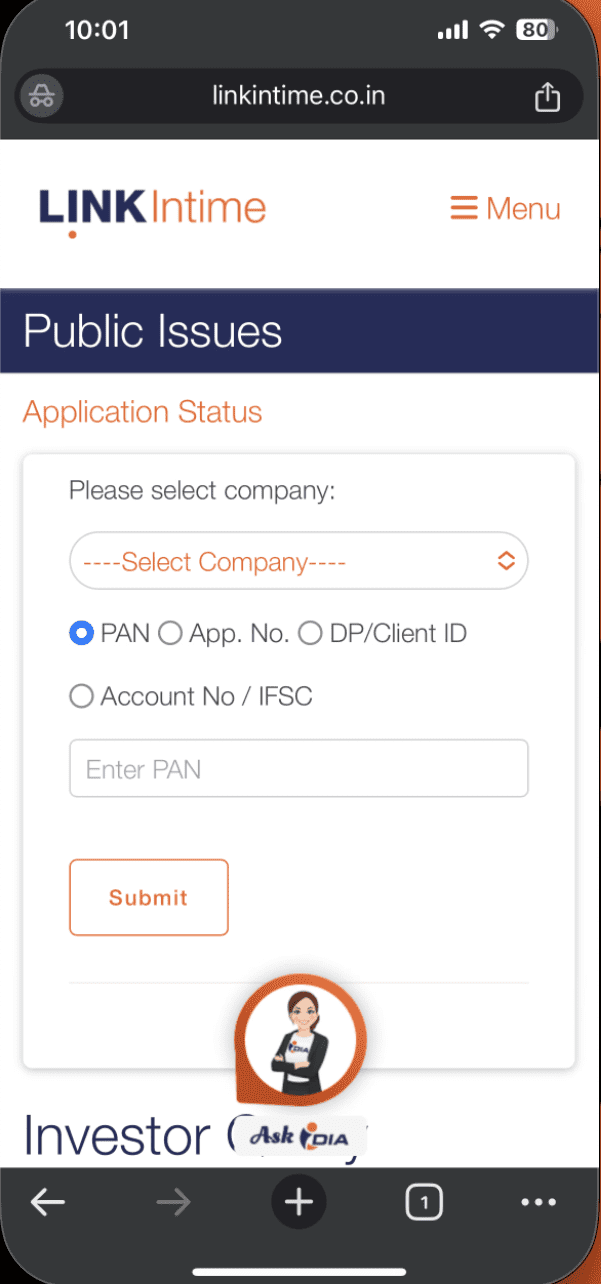

Step 1: Check Toss The Coin IPO Allotment Status on Link Intime

Visit the Link Intime Website: Go to the Toss The Coin IPO allotment page on Link Intime.

Select IPO Name: From the drop-down menu, choose ‘Toss The Coin’.

Provide Your Details

- Select the appropriate option: PAN Number, Application Number, or DP ID/Client ID.

- Enter the respective number based on your selection.

Search for Allotment: Click on the ‘Search’ button.

View Your Allotment Status: The allotment details will appear on your screen, whether you’re using a mobile or desktop device.

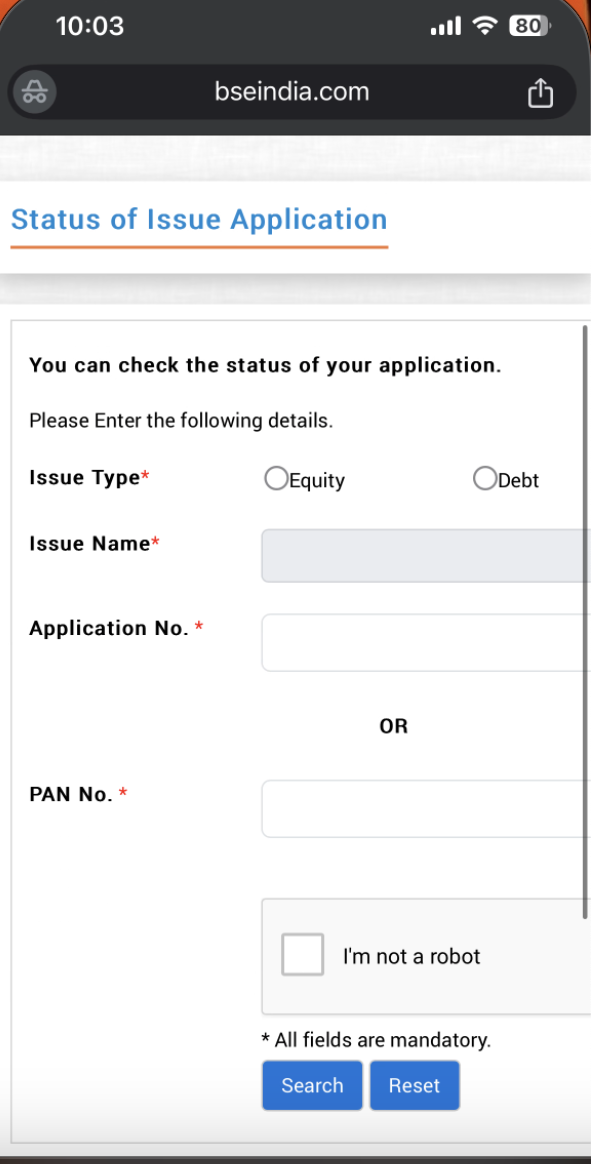

Step 2: Check Toss The Coin IPO Allotment Status on BSE

Visit the BSE Website: Go to the IPO allotment page on BSE.

Select IPO Name: From the drop-down menu, choose ‘Toss The Coin’.

Enter Your Details

- Select the option: PAN Number, Application Number, or DP ID/Client ID.

- Provide the relevant details as per your selection.

Search for Allotment: Click on the ‘Search’ button.

View Your Allotment Status: Your allotment status will be displayed on the screen.

Step 3: Check Toss The Coin IPO Allotment in Your Demat Account

Contact Your Broker or Login to Your Demat Account: Call your broker or access your trading/demat account online.

Verify Credited Shares

- Check if Toss The Coin shares have been credited to your demat account.

- If shares are visible, you have received the allotment.

Step 4: Check Toss The Coin IPO Allotment in Your Bank Account

Login to Your Bank Account: Access the bank account from which you applied for the IPO.

Check the Balance Tab

- If you received the allotment, the application amount will be debited.

- If not, the amount will be released.

Look for SMS Notifications

- If allotted, you may receive an SMS from your bank:

“Dear Customer, Bank Name Account XXXX is debited with INR XXXX.XX on Date. Info: Toss The Coin IPO. Available Balance is INR XXXXX.XX.”

About Company

Toss The Coin Ltd., established in 2020, is a marketing consultancy firm that specializes in providing custom marketing solutions to drive business growth. The company leverages a skilled and experienced team to deliver innovative strategies, impactful content, and creative designs that help businesses succeed in competitive markets. Its services include tailored marketing plans to boost sales, generate demand, and reinforce brand messaging, alongside impactful content creation and campaign development to enhance brand visibility and customer interaction. Toss The Coin also excels in shaping effective go-to-market (GTM) strategies, catering to both large and small tech firms.

The company has shown impressive financial growth, with revenue increasing from ₹297.33 lakhs in FY 2022 to ₹486.19 lakhs in FY 2024, reflecting its robust business model and market presence. To further fuel its growth and expand its services, Toss The Coin is launching an SME IPO valued at ₹9.17 crores. Investors with queries regarding IPO allotment or refunds can reach out to the IPO registrar, who oversees these processes.

Toss The Coin IPO Dates

| Event | Date | Details |

|---|---|---|

| IPO Open Date | Tuesday, December 10, 2024 | Subscriptions open for investors. |

| IPO Close Date | Thursday, December 12, 2024 | Last day to apply for shares. |

| Cut-off Time for UPI Mandate Confirmation | 5 PM on December 12, 2024 | Mandates must be confirmed by this time. |

| Basis of Allotment Finalization | Friday, December 13, 2024 | Allotment of shares to investors will be finalized. |

| Initiation of Refunds | Monday, December 16, 2024 | Refunds for unallotted shares will be initiated. |

| Credit of Shares to Demat Accounts | Monday, December 16, 2024 | Allotted shares will be credited to investors' demat accounts. |

| Listing Date | Tuesday, December 17, 2024 | Shares will be listed on the BSE SME platform. |