The eagerly awaited allotment status for the Zinka Logistics Solutions Ltd (Blackbuck) IPO is now available as of November 19, 2024. Investors can finally check their allotment as the basis of allotment has been finalized. This follows the company’s successful Rs 1,115 crore IPO, which concluded its subscription period on November 18, 2024.

Overview of Contents

Zinka Logistics (Blackbuck) IPO Allotment Status

The IPO was oversubscribed 1.86 times, with 4,19,57,676 shares bid against 2,25,66,210 shares on offer.

| Category | Details |

|---|---|

| Subscription Details | |

| QIBs (Qualified Institutional Buyers) | Subscribed 2.76 times |

| Retail Investors | Subscribed 1.16 times |

| NIIs (Non-Institutional Investors) | Subscribed 0.24 times |

| Employee Reservation | Subscribed 9.88 times |

| Price Band | Rs 259-273 per share |

| Lot Size | 54 shares |

| Listing Date | November 21, 2024 on BSE and NSE |

| Issue Composition | |

| Fresh Issue | Rs 550 crore |

| Offer for Sale | 2.16 crore shares |

You can check the allotment status of the Zinka Logistics (Blackbuck) IPO through the following methods

Zinka Logistics (Blackbuck) IPO Allotment Links

| KfinTech: | KfinTech IPO Allotment Page |

| BSE, NSE: | BSE, NSE IPO Allotment Page |

| IPO Watch: | IPO Allotment Status Page |

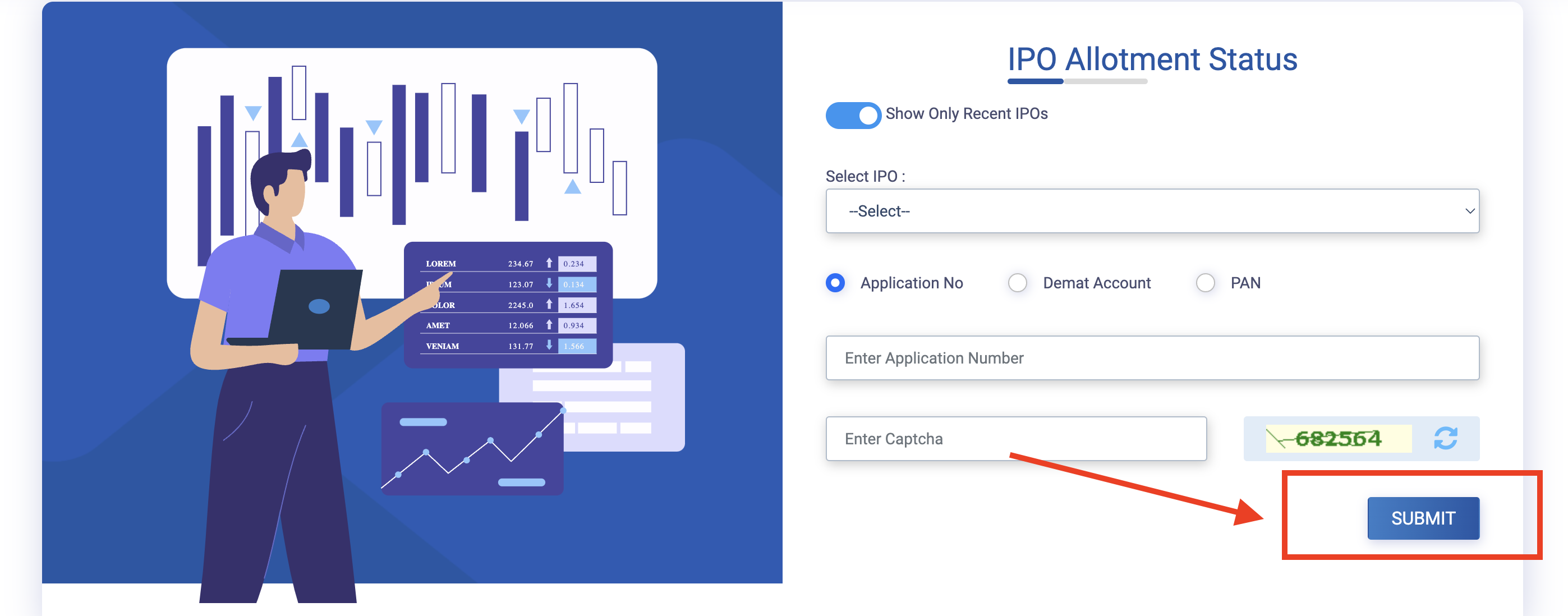

STEP I: How do you check Zinka Logistics (Blackbuck) IPO Allotment Status on KfinTech?

- Visit the KFinTech IPO page.

- Select the IPO name ‘Blackbuck’ from the dropdown menu.

- Choose an identification method: PAN, Application Number, or DP ID.

- Enter the relevant details and click Search.

- View the allotment status on your screen.

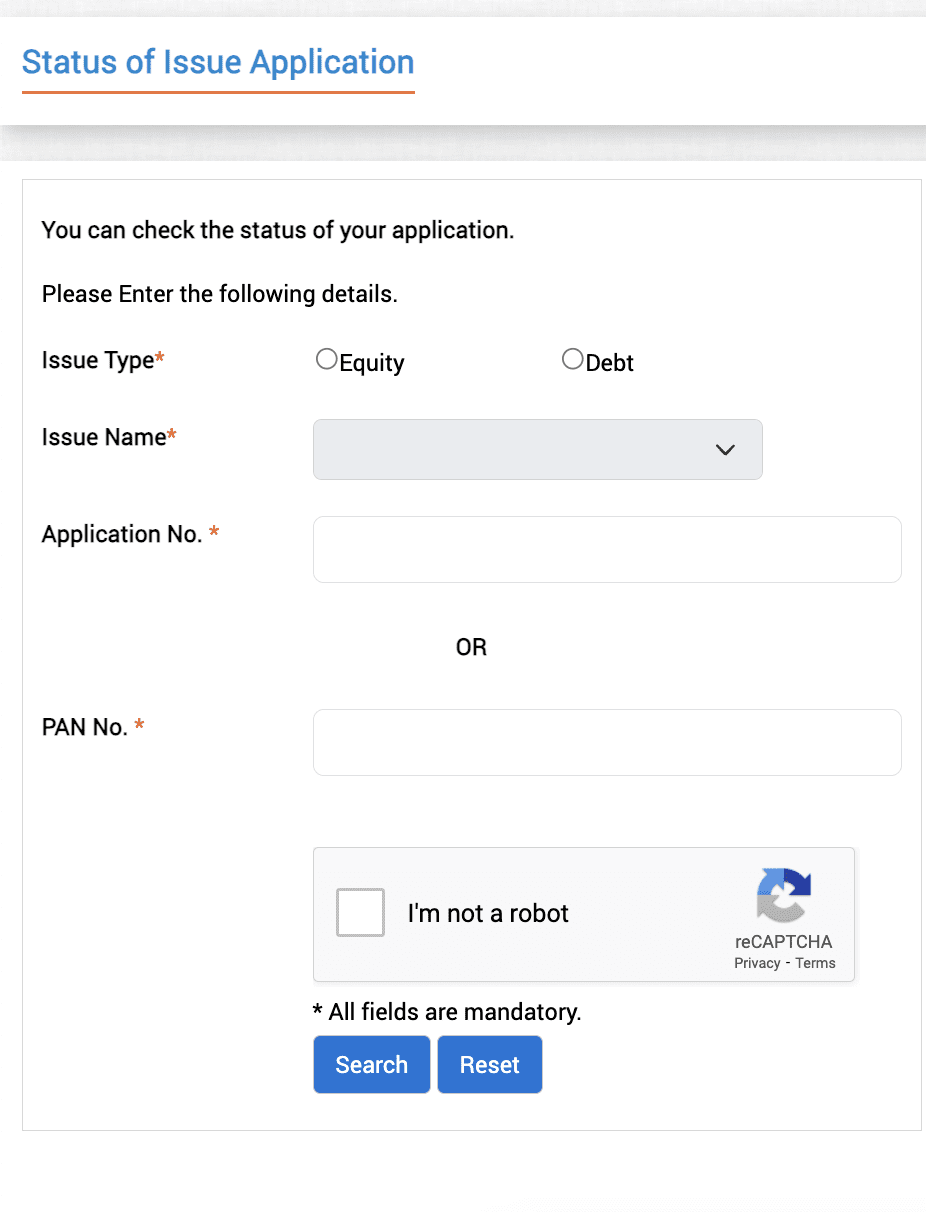

STEP II: How do you check Blackbuck IPO Allotment Status on BSE?

- Go to the BSE IPO Allotment page.

- Select Equity as the issue type.

- Choose Blackbuck from the dropdown.

- Enter your Application Number and PAN.

- Click Search to view the allotment status.

STEP III: Through Demat Account

- Contact your broker or log in to your Demat/Trading account.

- Check if the allotted shares are credited to your account.

STEP IV: Via Bank Account

- Log in to the bank account you used for the IPO application.

- Check your transaction history:

- If shares are allotted, the IPO amount will be debited.

- If not, the blocked amount will be released.